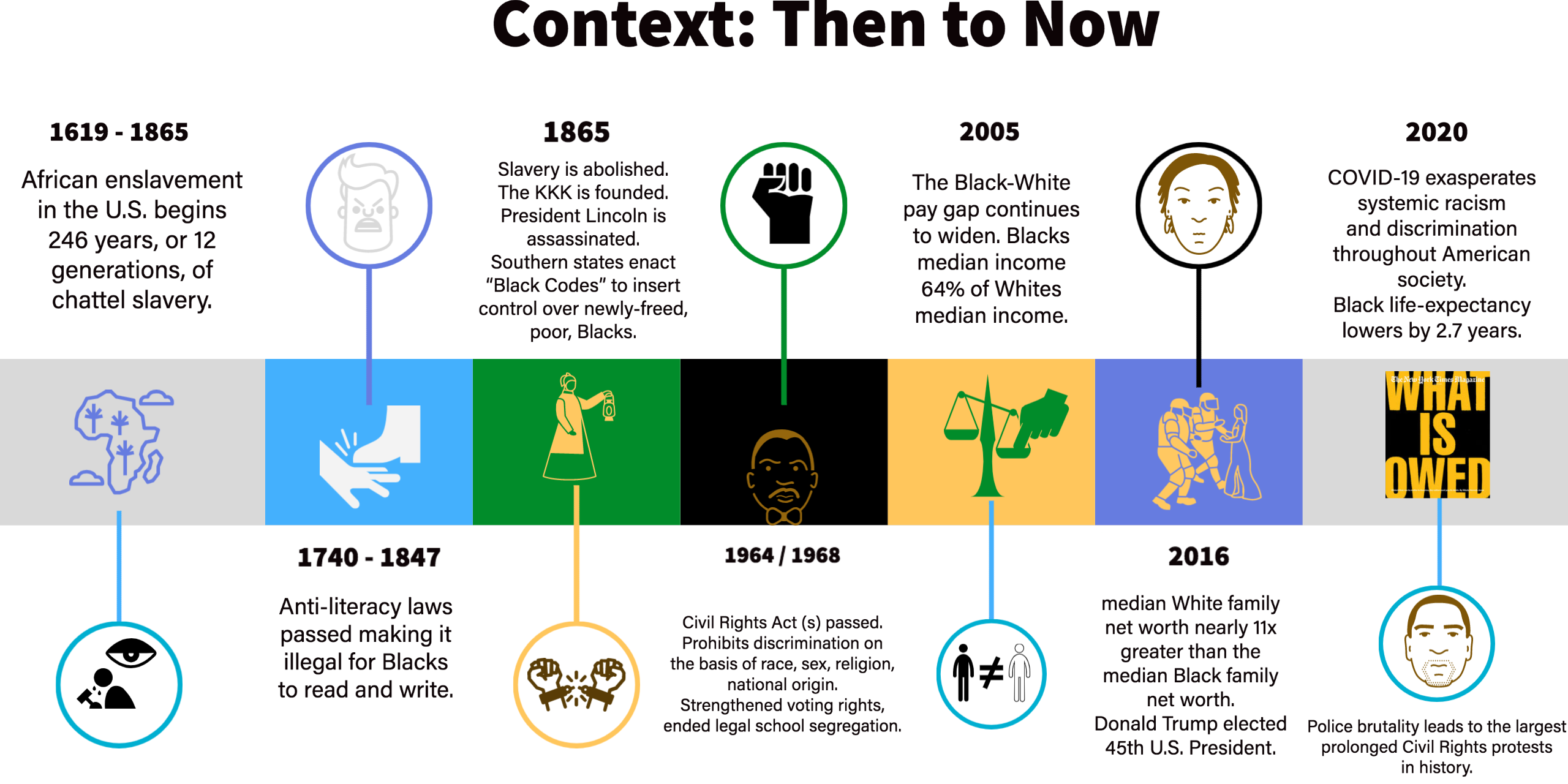

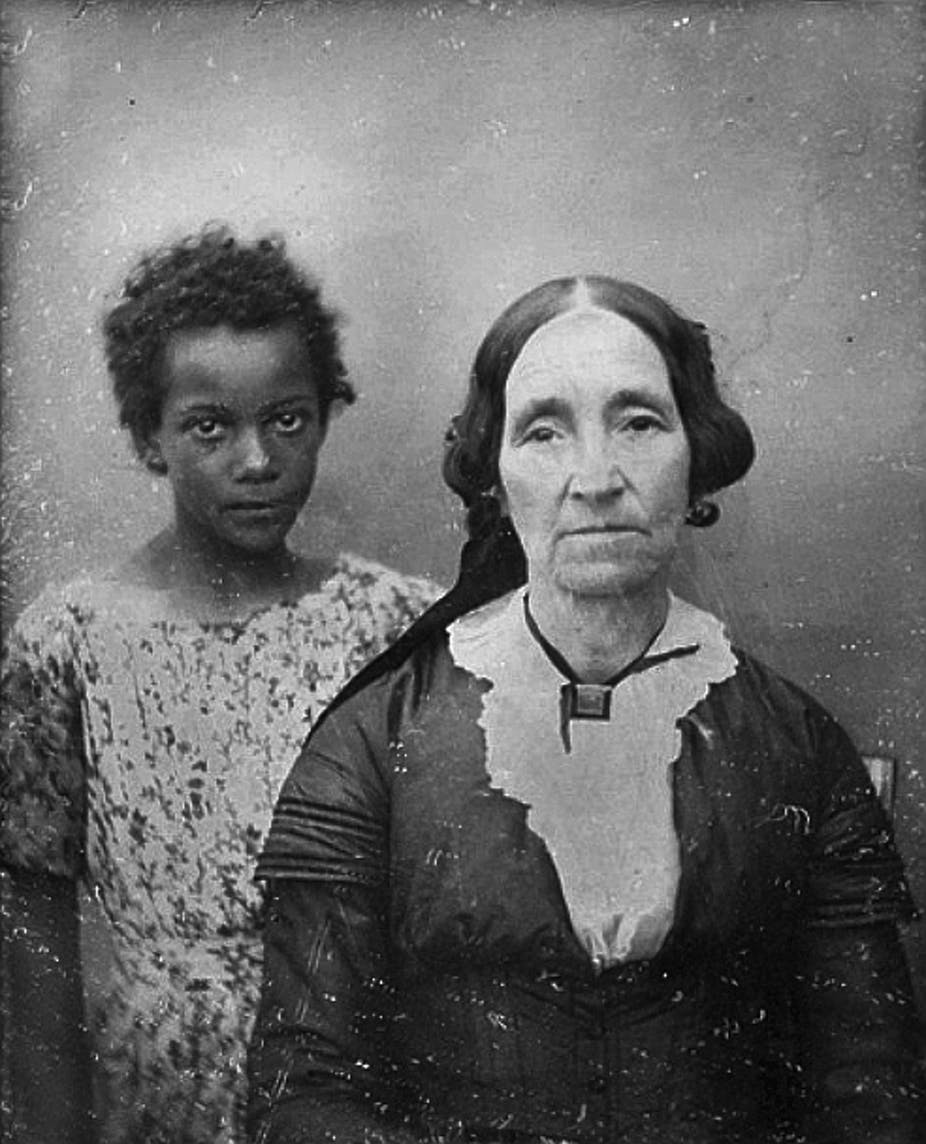

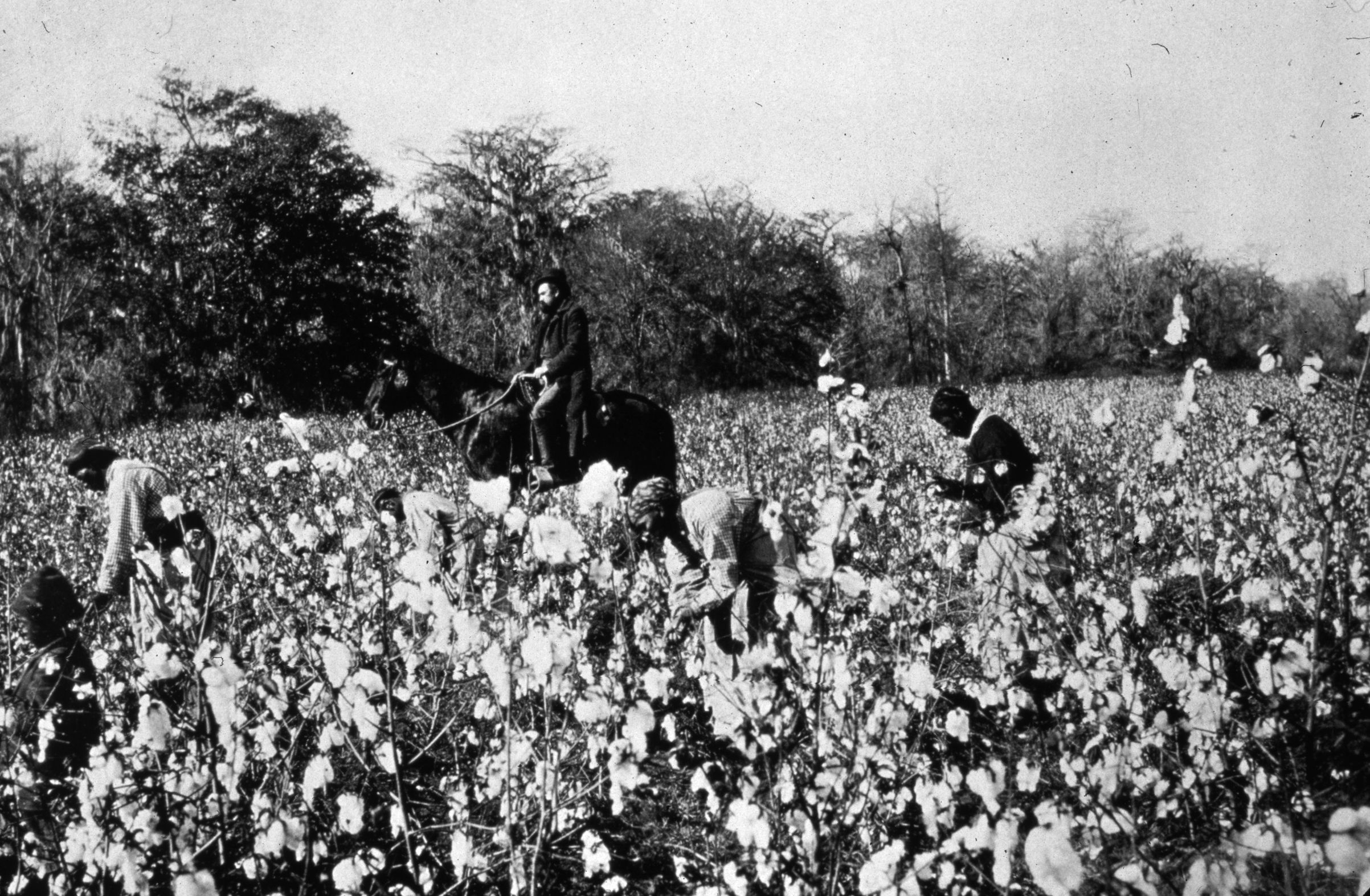

235 years of enslavement and forced labor,

100 years of Jim Crow discrimination,

65 years of denial and inaction around entrenched systemic prejudice.

Property ownership and higher education are two primary sources

of wealth creation and upward social mobility America.

For 400 years, Black Americans have been systemically excluded from both.

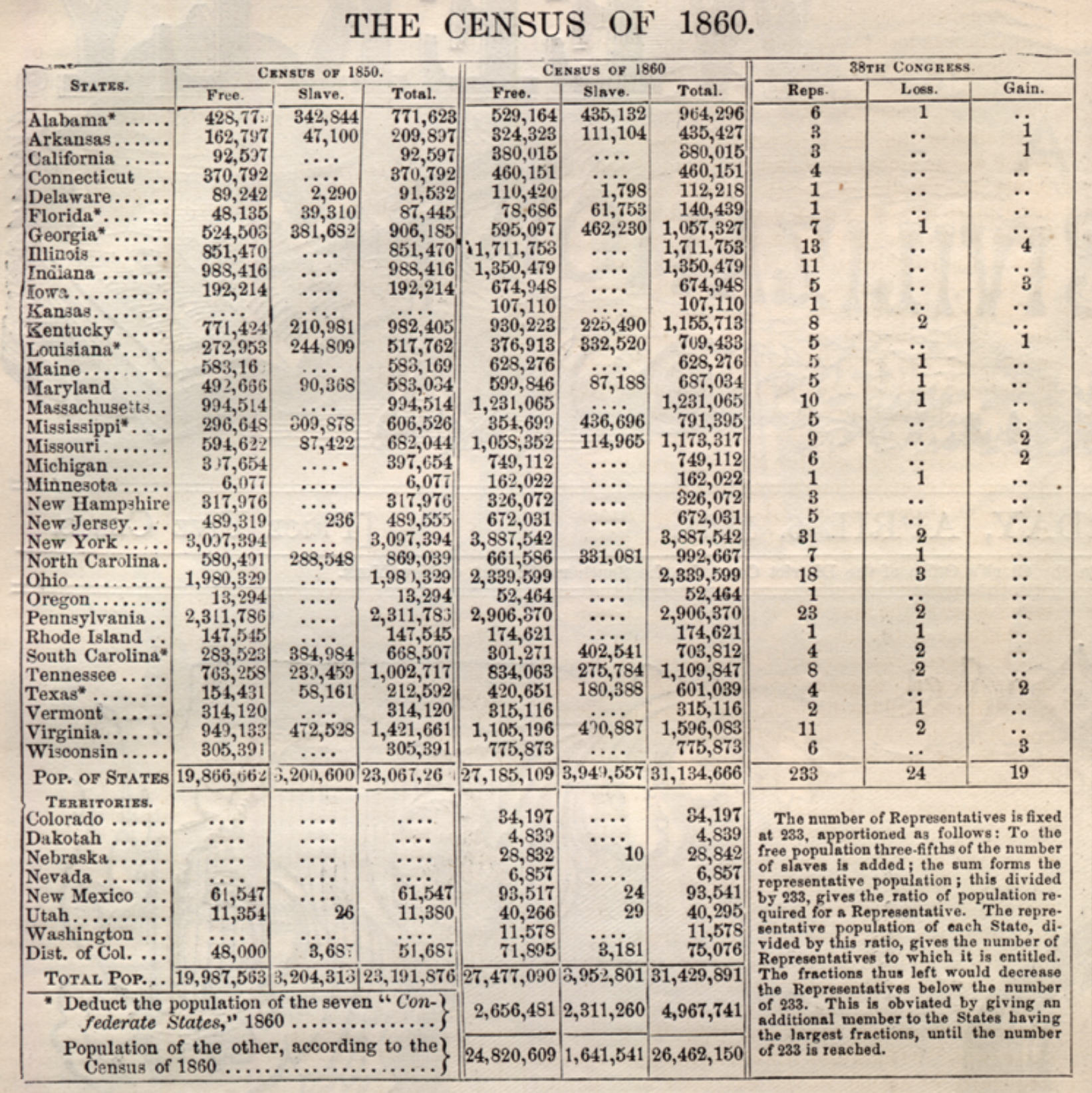

Enslaved Black Americans were the largest financial asset in the United States. By 1860, there were more millionaires (all slaveholders) living in the lower Mississippi Valley than anywhere else in the U.S.

![Cotton by Justice Nnanna]()

The nearly 4 million enslaved people were worth some $3.5 billion, making them the largest single financial asset in the entire U.S. economy, worth more than all manufacturing and railroads combined.

Post-slavery newly freed enslaved people with no wealth became sharecroppers, laboring for a place to live, earning little, or no, money.

The nearly 4 million enslaved people were worth some $3.5 billion, making them the largest single financial asset in the entire U.S. economy, worth more than all manufacturing and railroads combined.

Post-slavery newly freed enslaved people with no wealth became sharecroppers, laboring for a place to live, earning little, or no, money.

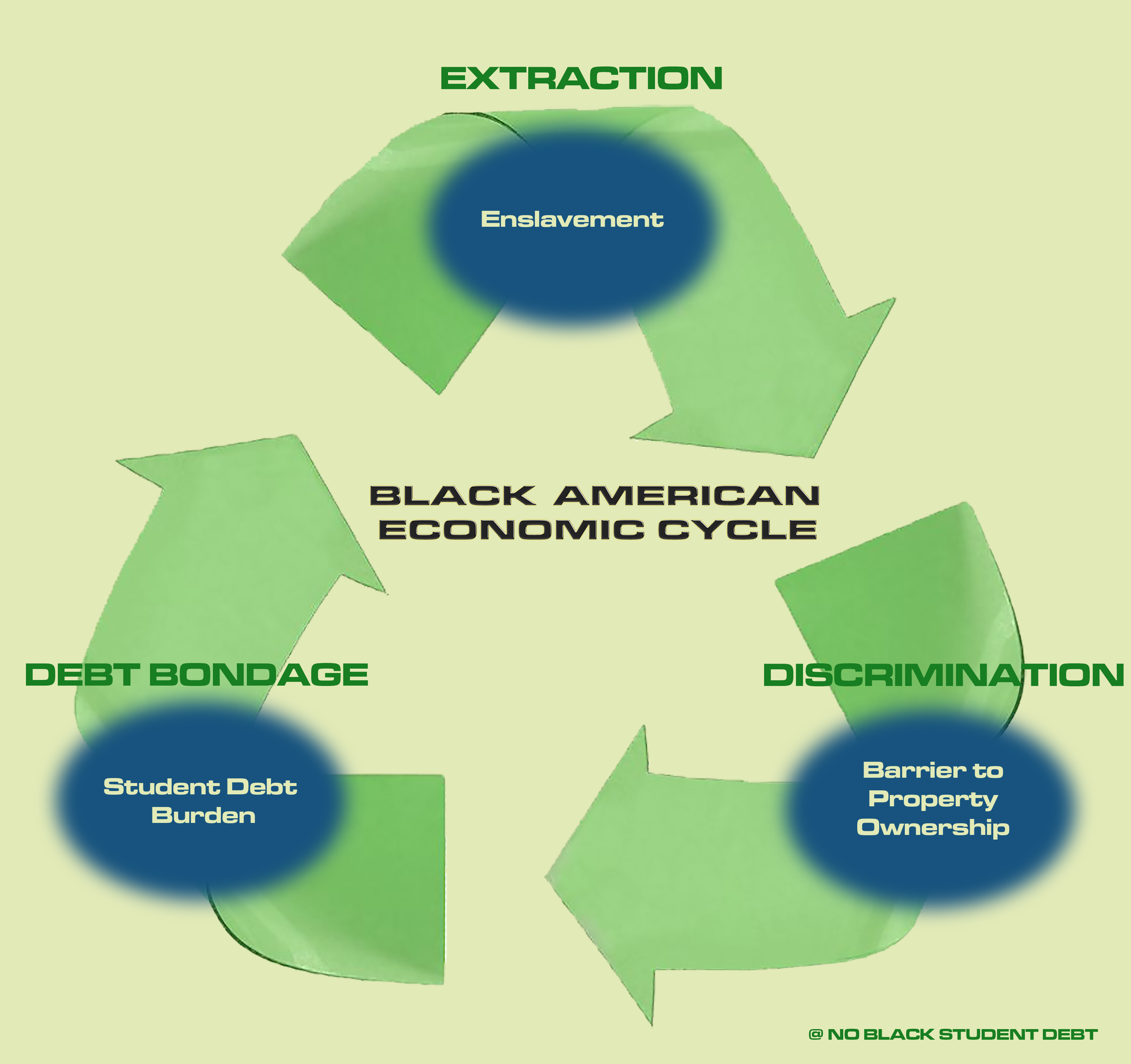

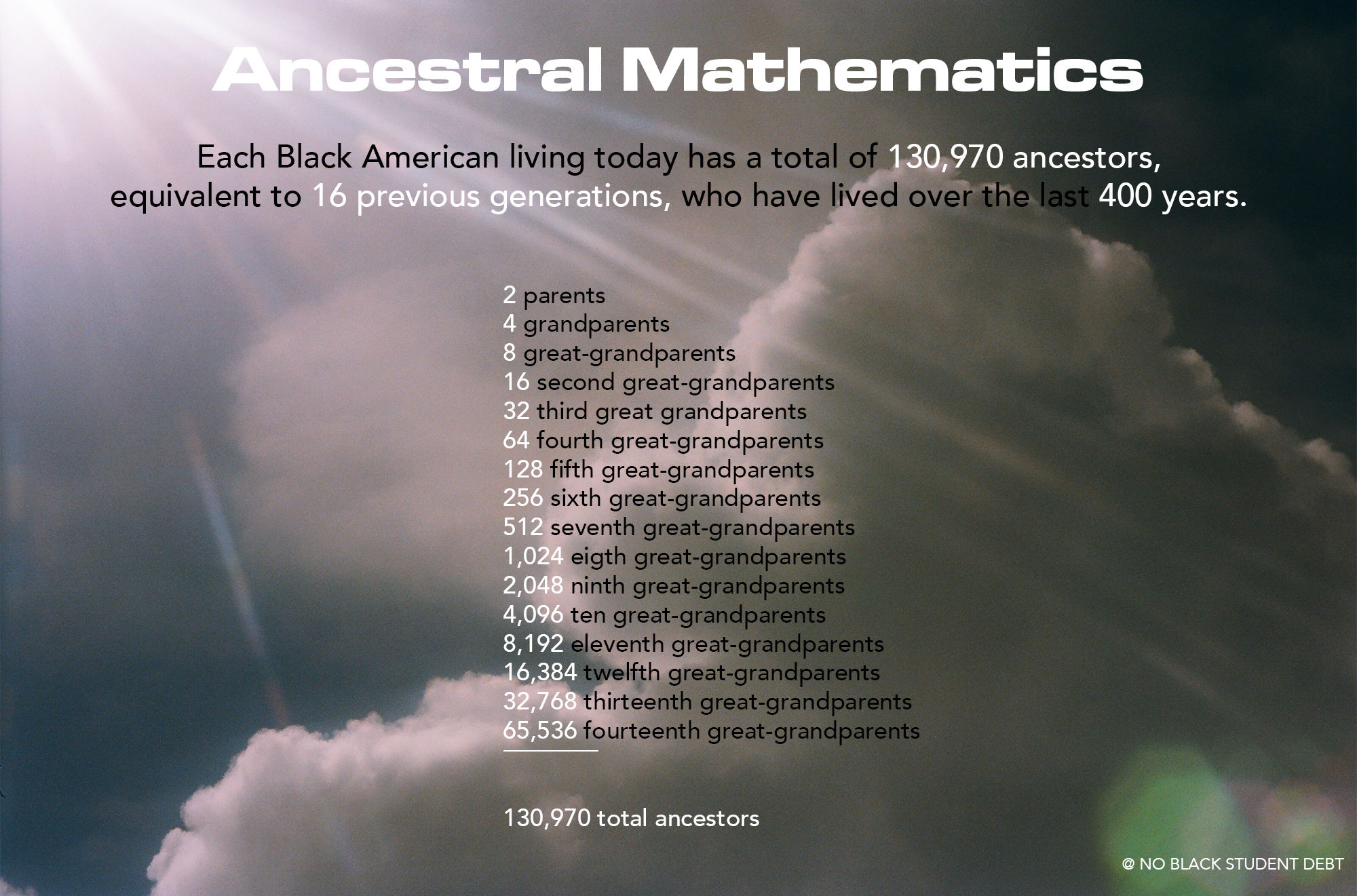

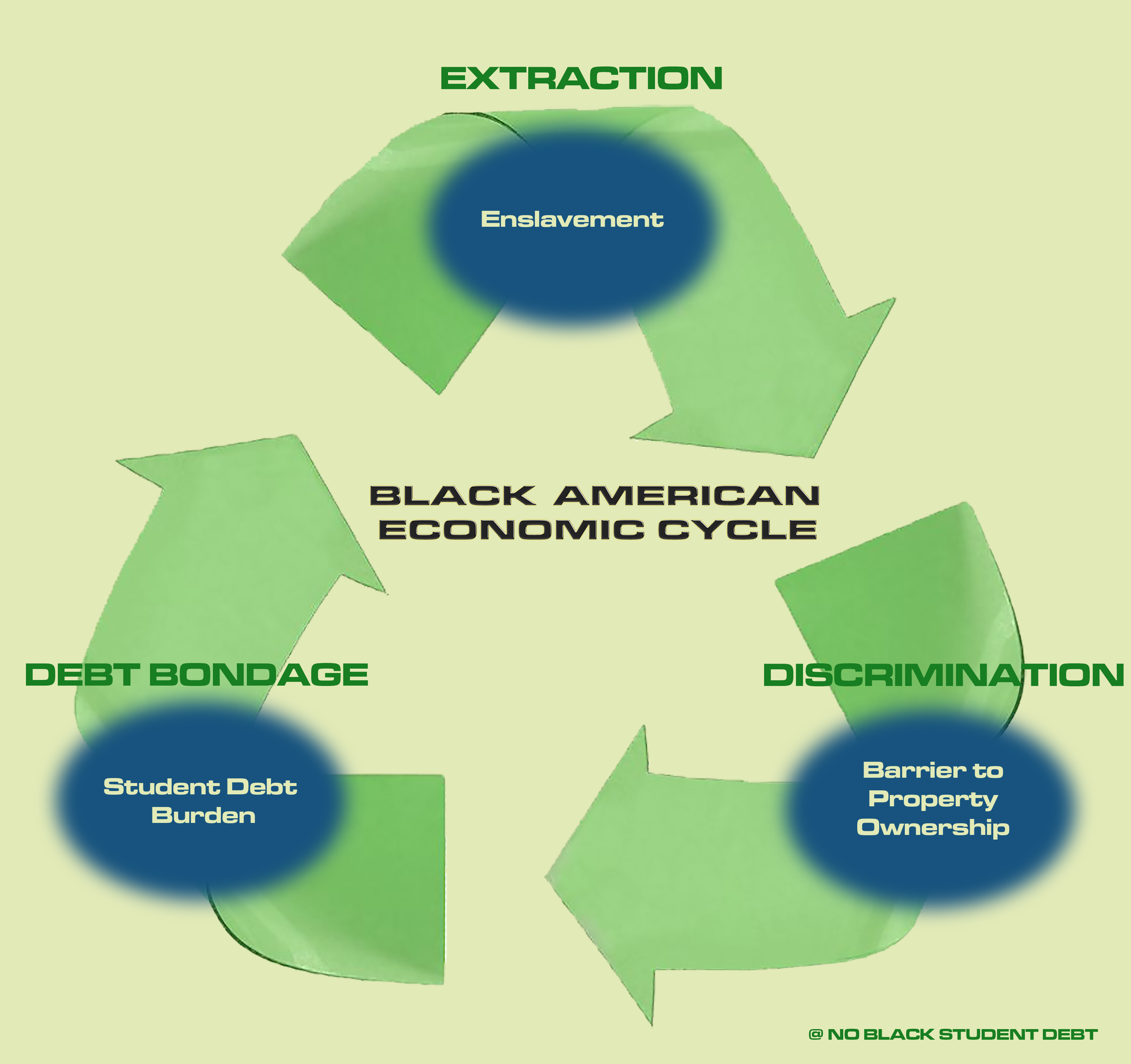

Black Americans are the descendants of a 400 year legacy of rampant structural wealth extraction.

American Slavery and subsequent legal discrimination have extracted humanity and funneled significant economic gains away from Black Americans.

As cotton was the leading American export from 1803-1937 - U.S. continued to profit off of free, and cheap, Black labor.

As cotton was the leading American export from 1803-1937 - U.S. continued to profit off of free, and cheap, Black labor.

“Cotton cloth itself had become the most important merchandise European traders used to buy slaves in Africa. Planters discovered that climate and rainfall made the Deep South better cotton territory than the border states. Nearly a million American slaves were forcibly moved to Georgia, Mississippi and elsewhere, shattering many families in the process.”

- ‘Empire of Cotton,’ by Sven Beckert

This historic wealth extraction has exasperated the racial wealth gap, resulting in a crisis of Black student debt.

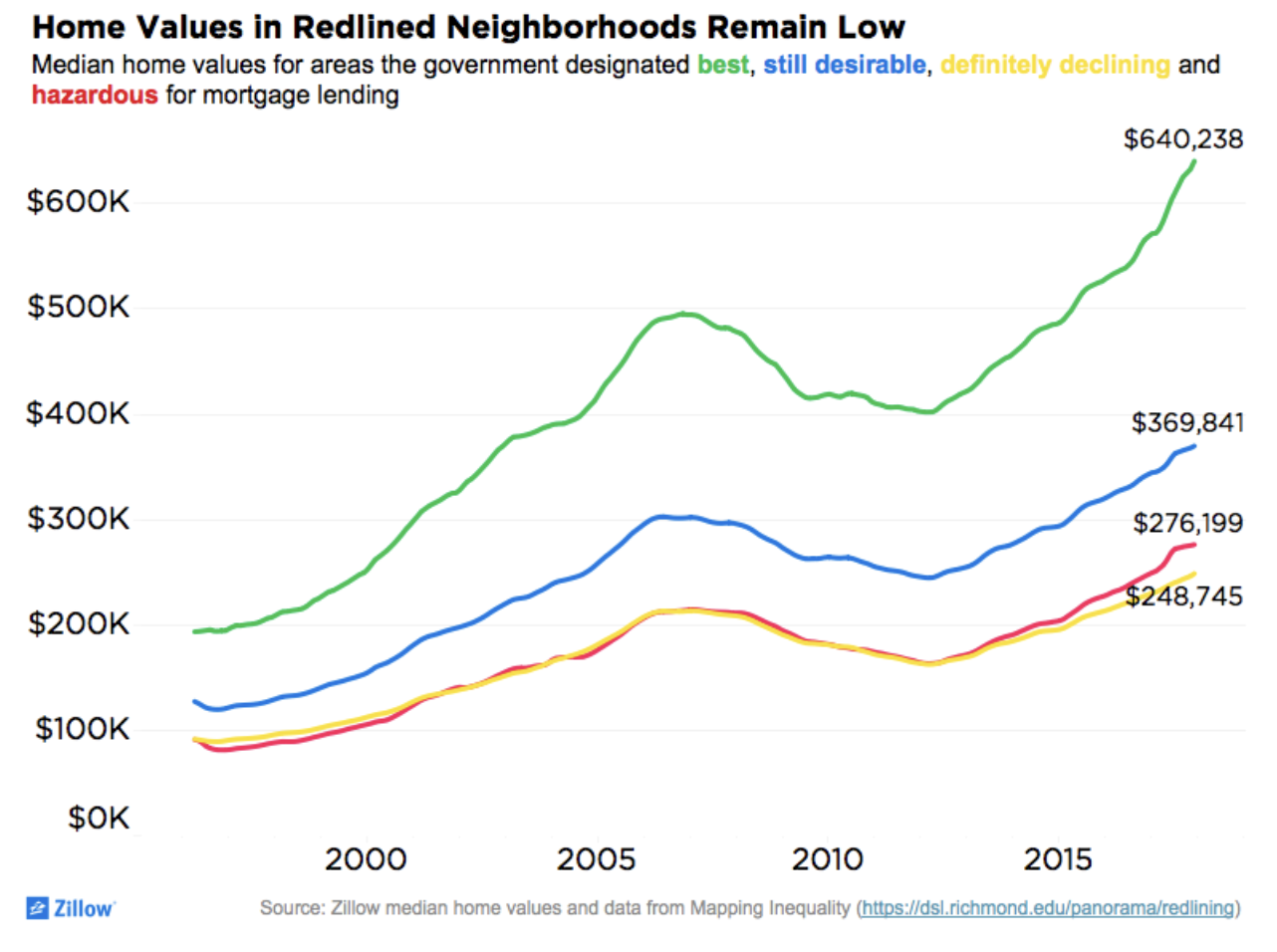

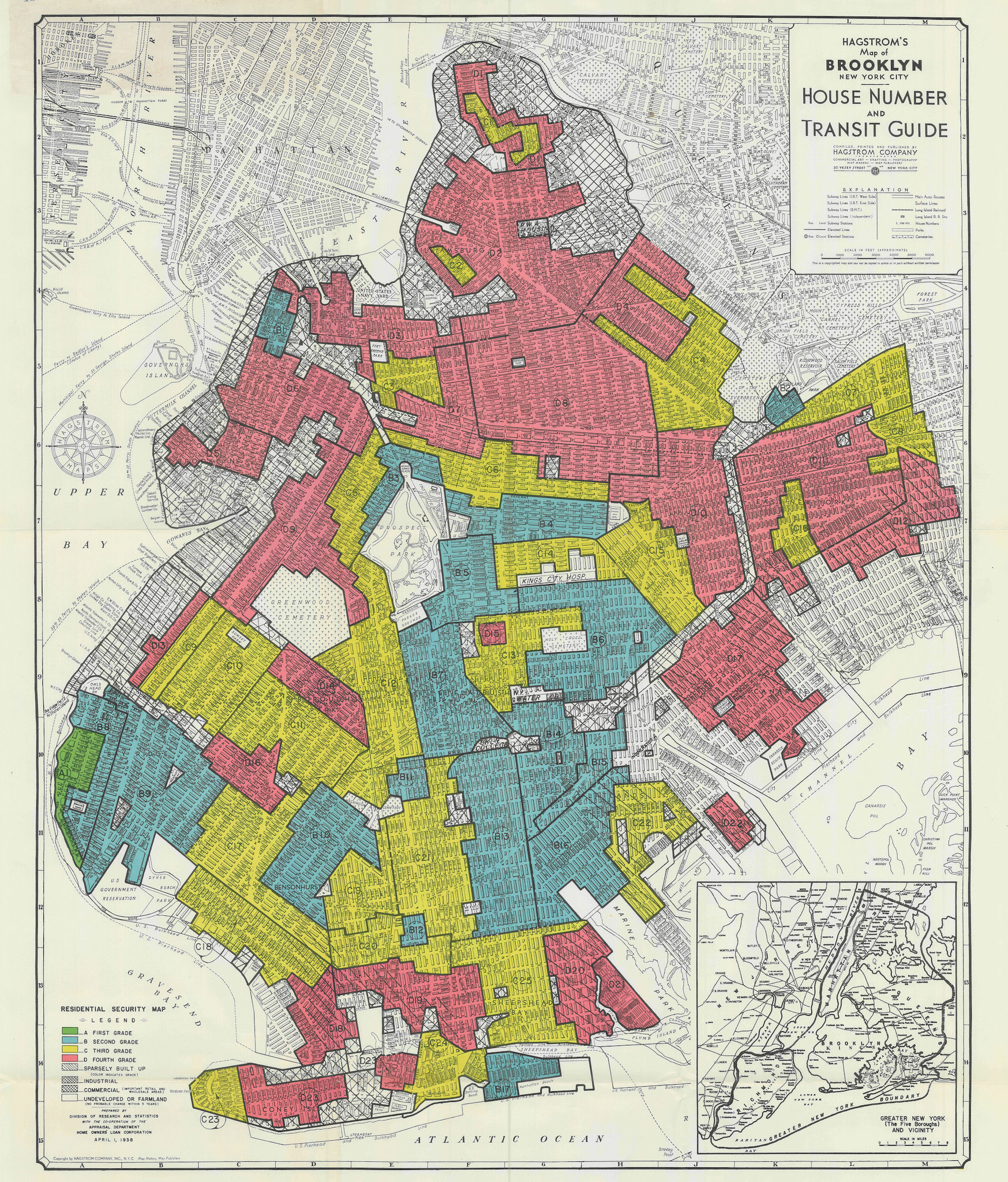

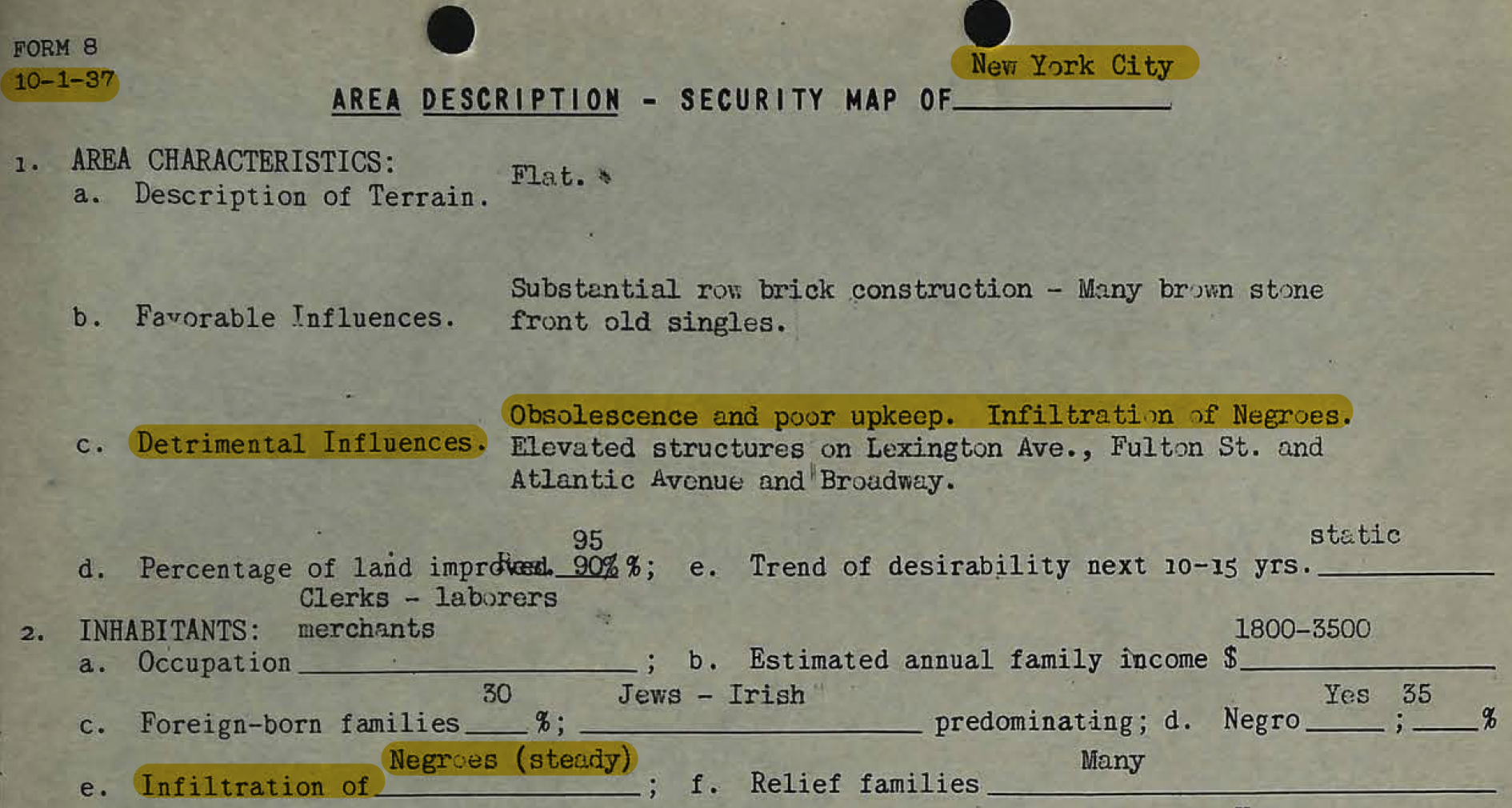

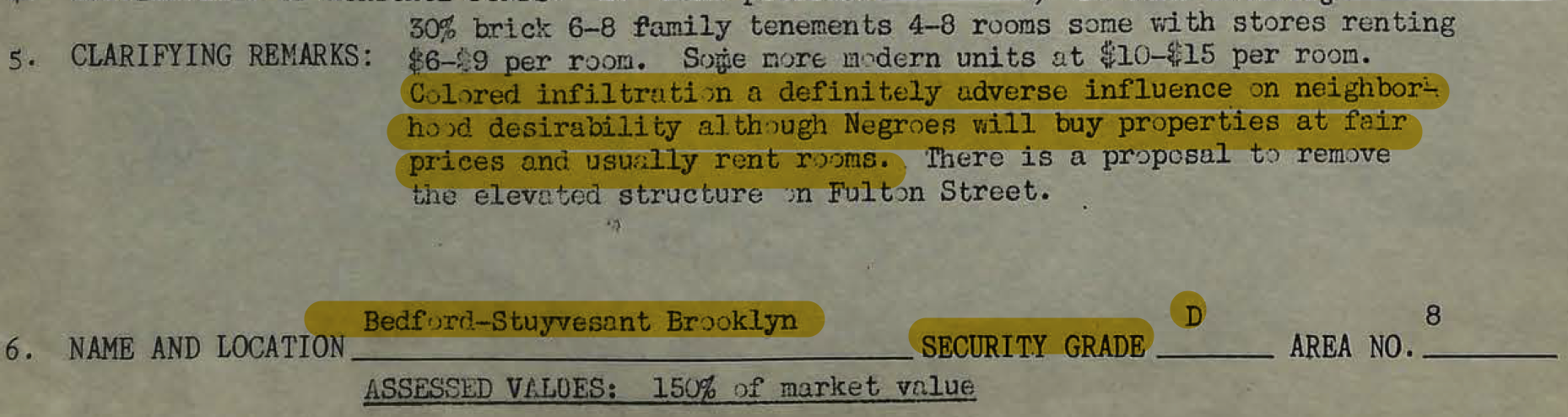

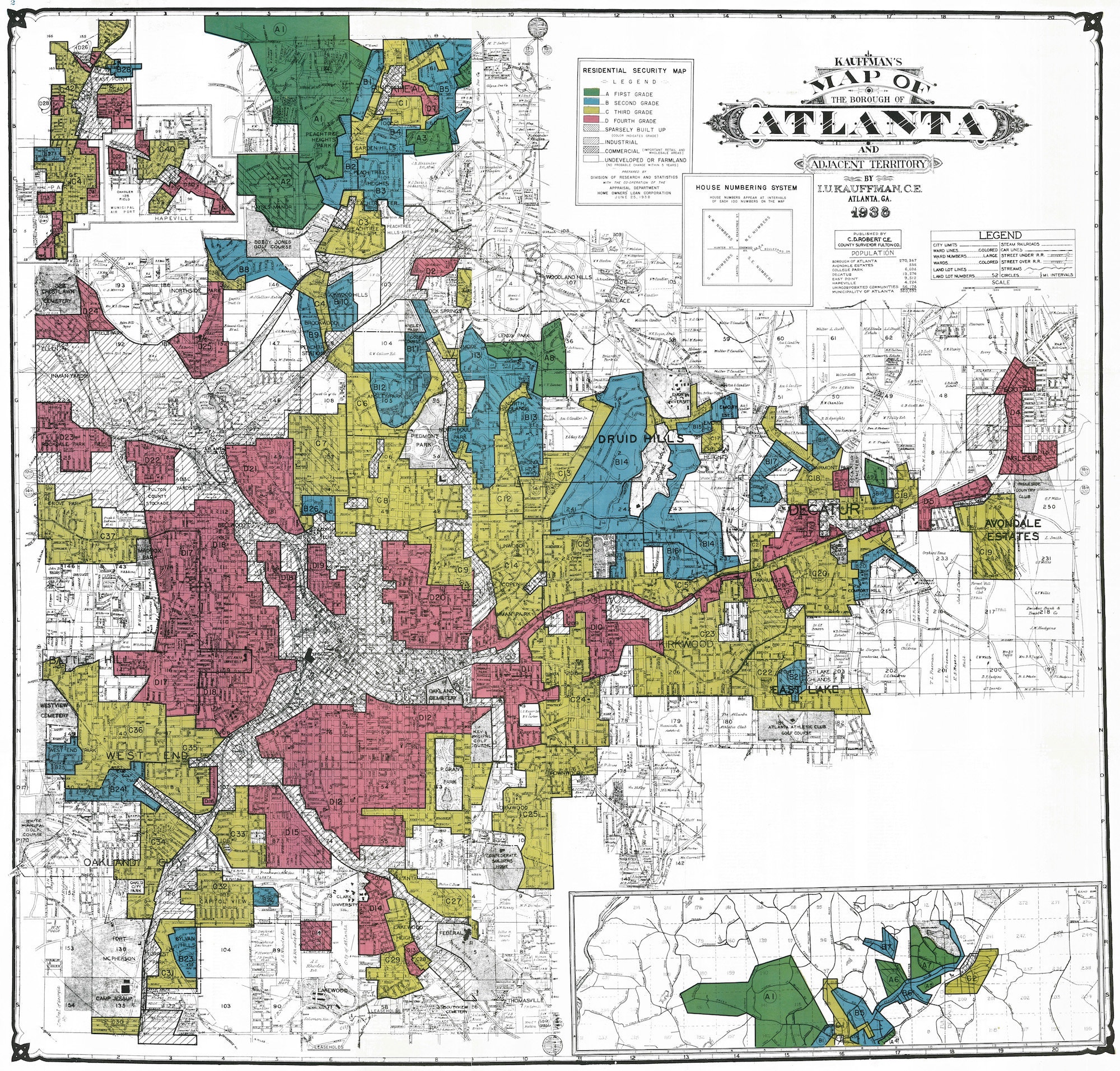

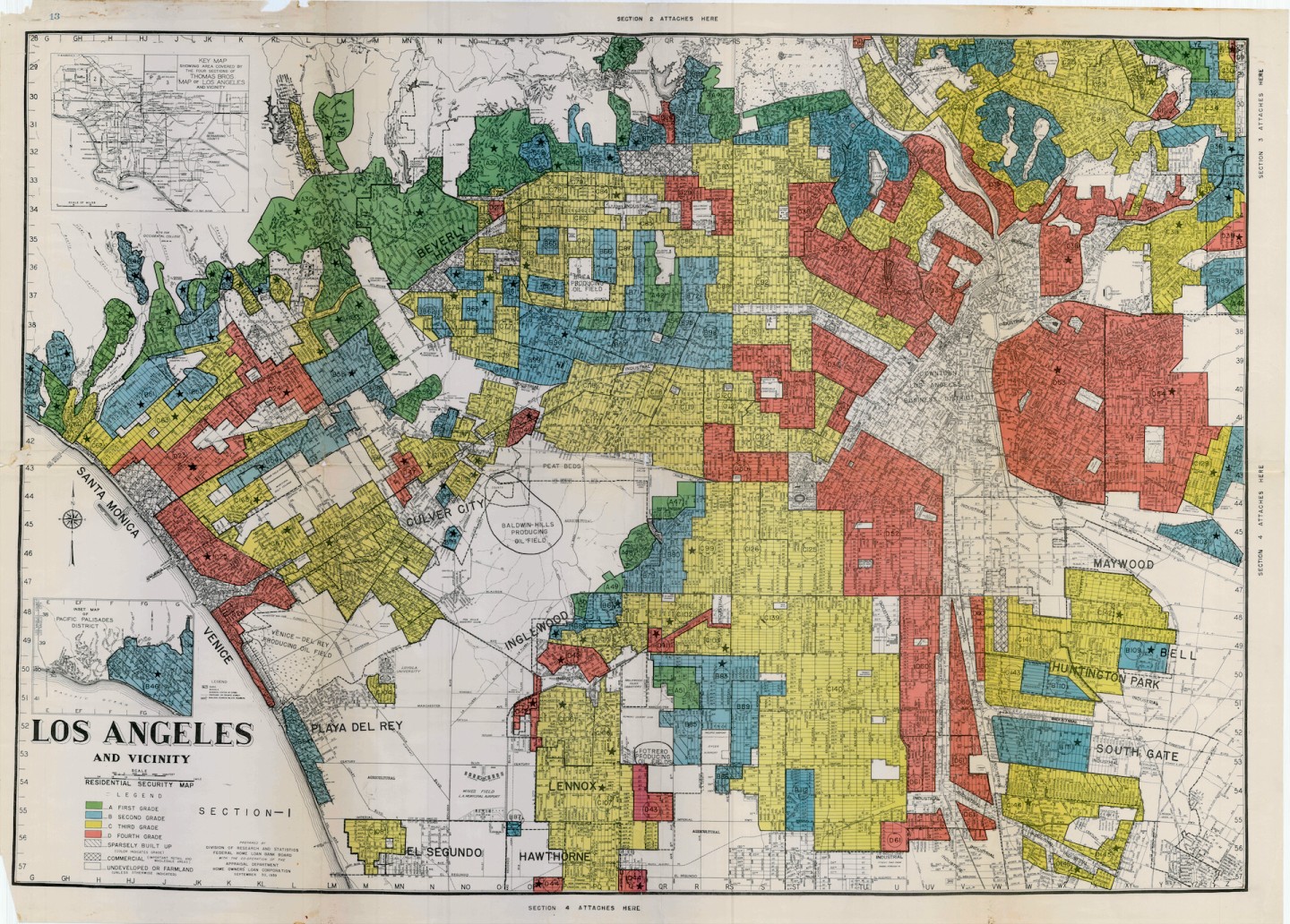

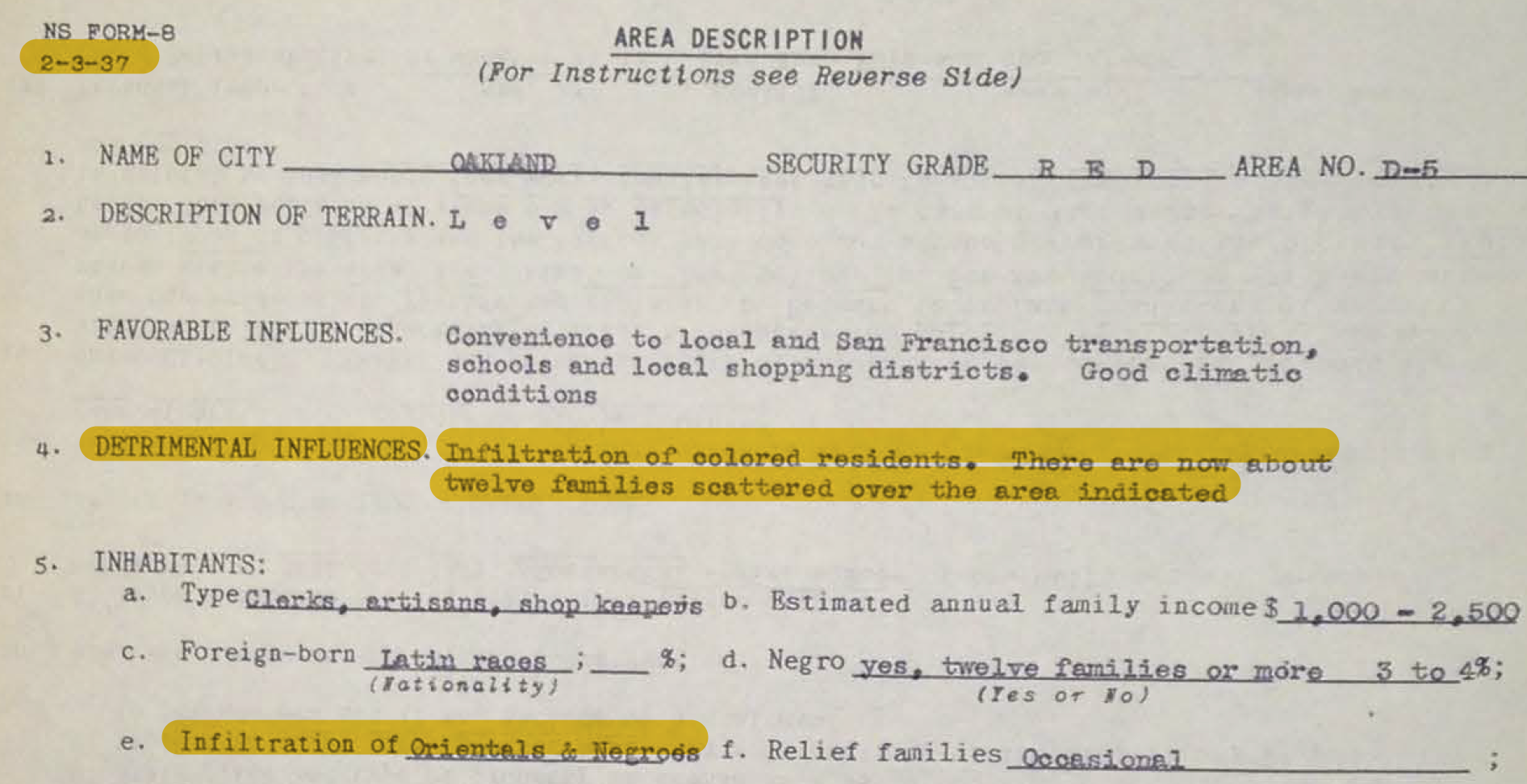

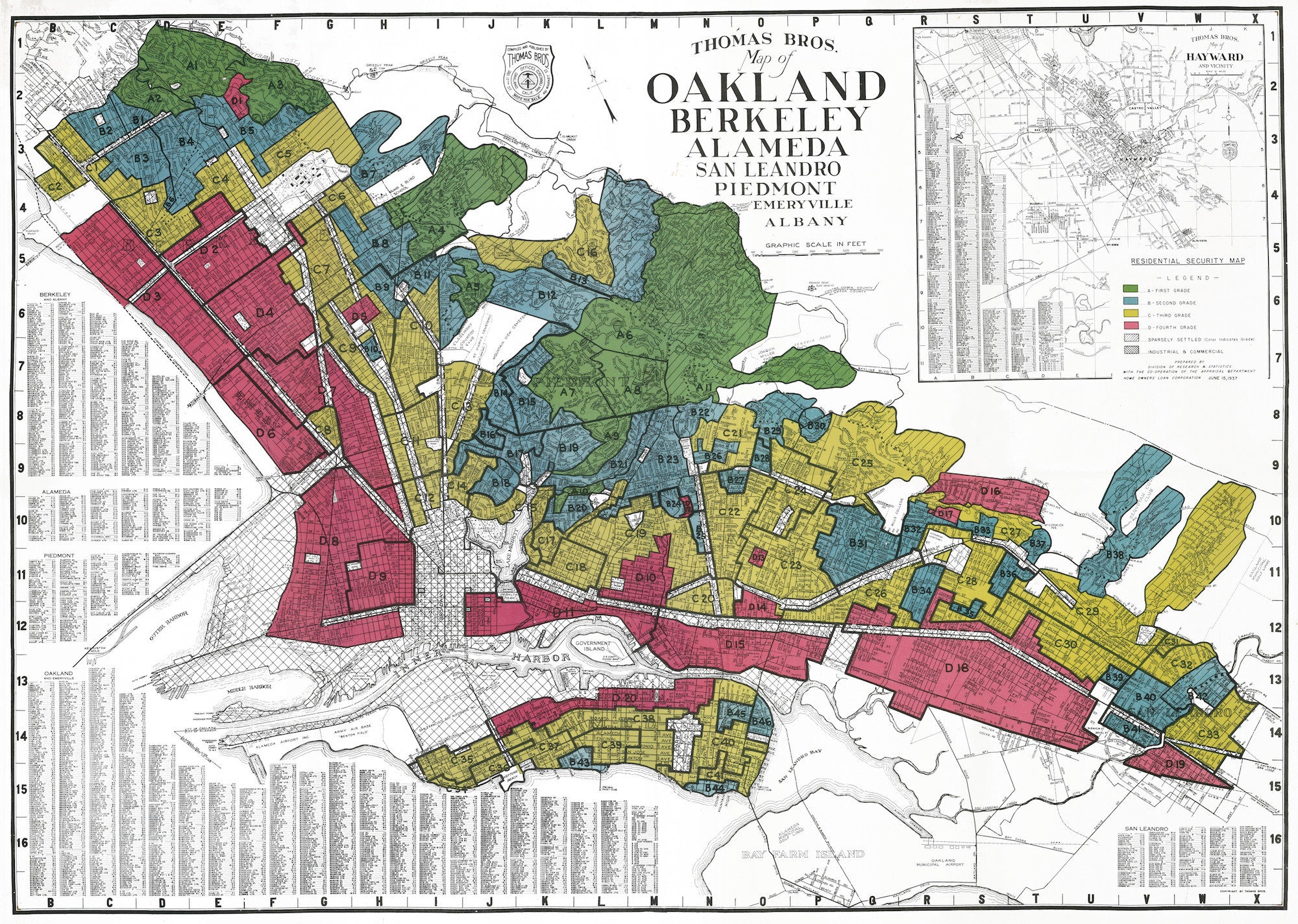

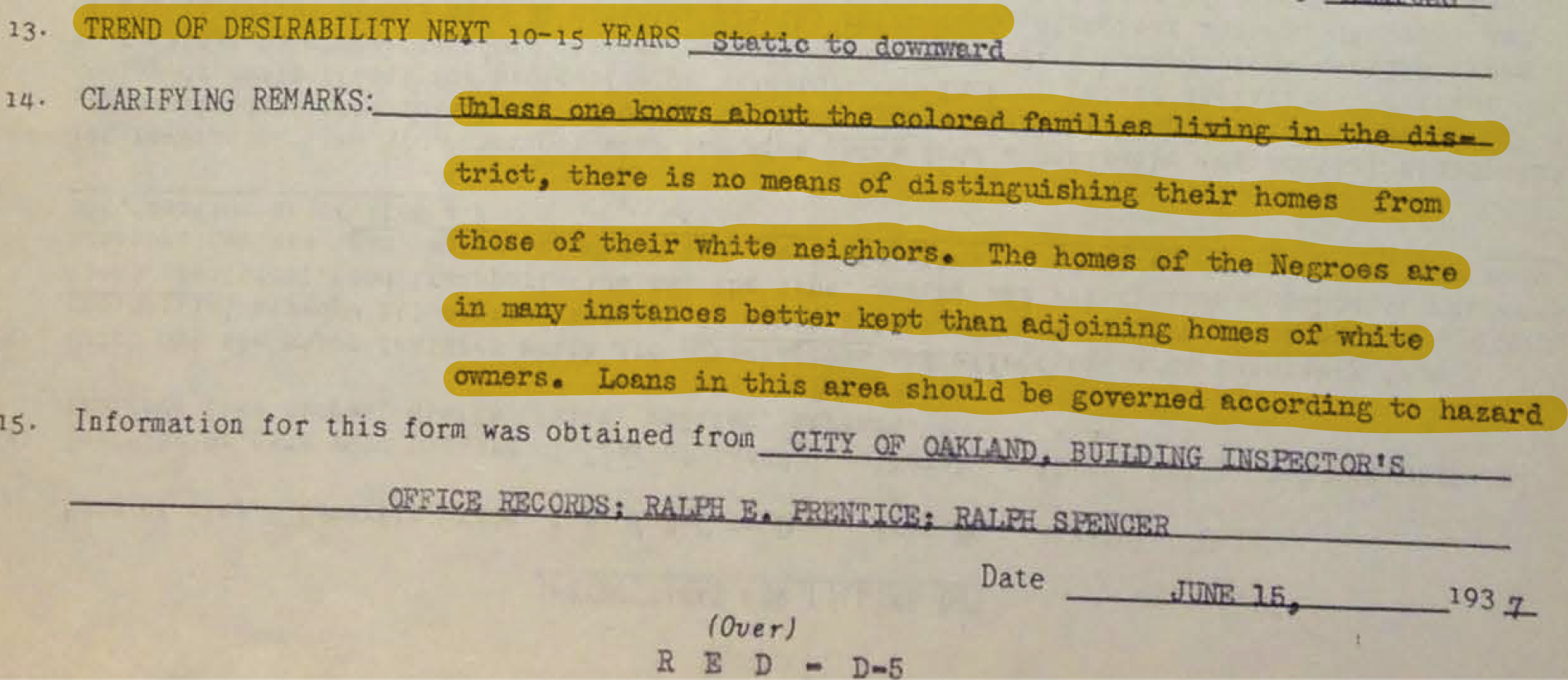

U.S. federal housing policies in the 20th century mandated segregation and undermined the ability of Black homeownership and wealth generation.

Redlining is a discriminatory practice that puts services out of reach for residents of certain areas based on race or ethnicity. It can be seen in the systematic denial of mortgages, insurance, loans, and other financial services based on location (and that area’s history) rather than on an individual’s qualifications.

Redlining actively widened the Racial Wealth Gap in the United States.

Homes in the majority of neighborhoods “redlined” as hazardous by the federal government 80 years ago are lower in value now than in areas rated more highly then.

“An analysis of property values in 1996, property in redlined neighborhoods was worth less than half that of homes in what the government had deemed as “best” for mortgage lending. That disparity has only grown greater in the last two decades.” (Read Zillow’s “Home Values Remain Low in Vast Majority of Formerly Redlined Neighborhoods”)

Federal discrimination – financial and racial – codified less than a century ago continues to affect homeowners, whole communities affected by poverty, and stifle Black wealth.

Homes in the majority of neighborhoods “redlined” as hazardous by the federal government 80 years ago are lower in value now than in areas rated more highly then.

“An analysis of property values in 1996, property in redlined neighborhoods was worth less than half that of homes in what the government had deemed as “best” for mortgage lending. That disparity has only grown greater in the last two decades.” (Read Zillow’s “Home Values Remain Low in Vast Majority of Formerly Redlined Neighborhoods”)

Federal discrimination – financial and racial – codified less than a century ago continues to affect homeowners, whole communities affected by poverty, and stifle Black wealth.

See below for official discriminatory comments and redlined maps (1937)made by the Home Owners’ Loan Corporation, the government-sponsored corporation created as part of the New Deal.

“Colored infiltration a definitely adverse influence on neighborhood...”

“Property in this area, if acquired, should be sold as quickly as possible.”

“Occupied by Negroes and other subversive racial elements.”

“Infiltration of colored residents.”

The State of Property Ownership:

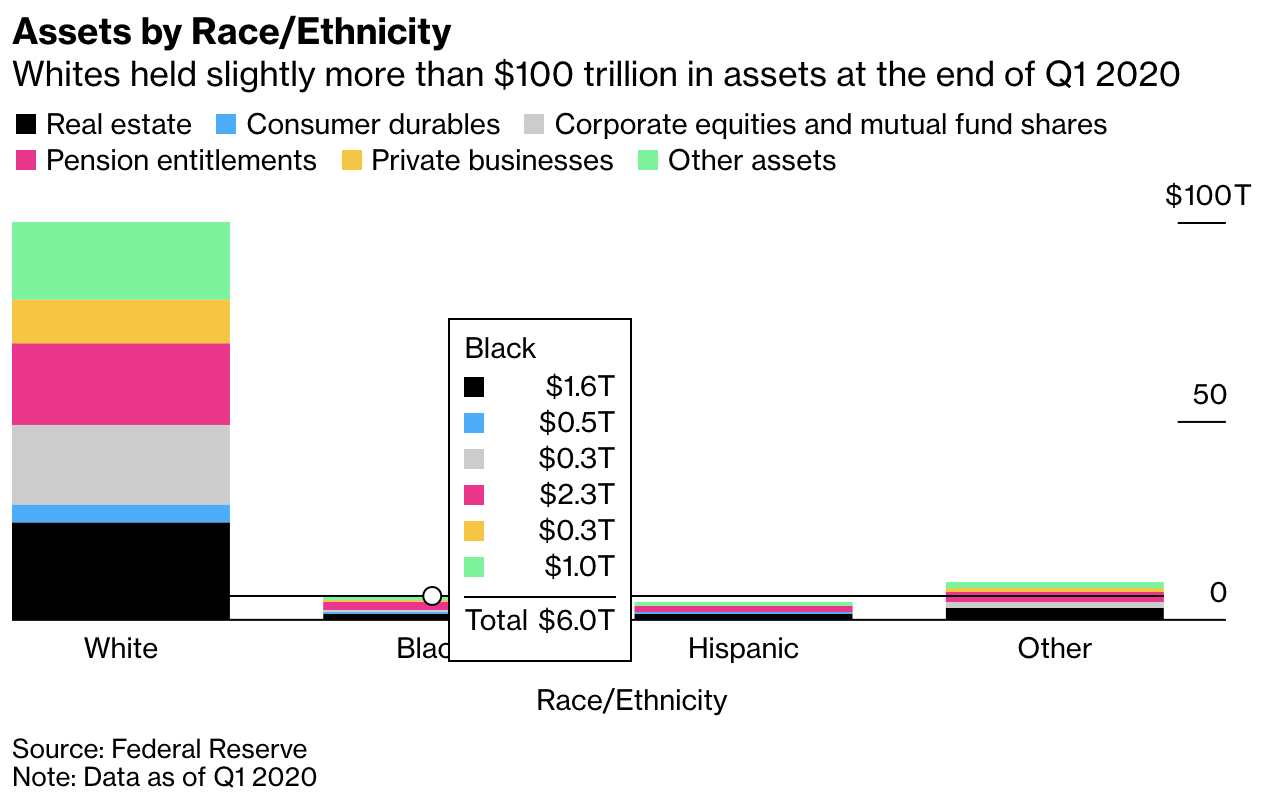

Of the $30.8 trillion in total real estate assets reported in 2020 Q2,

Black households held 5% ($1.6 trillion),

White households held 78% ($23.9 trillion).

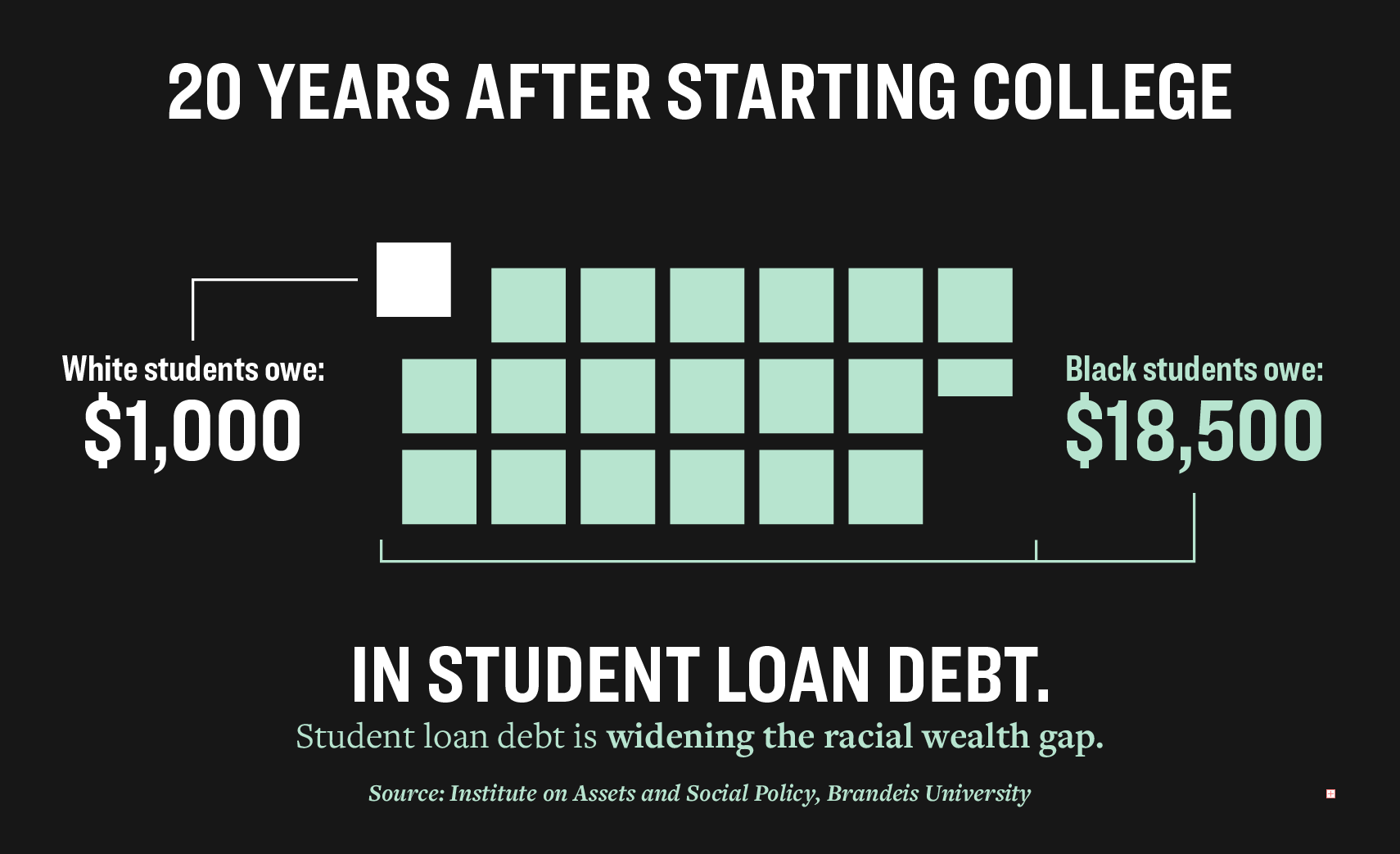

The result of converging debt and income realities are long-term entrapments with student debt that exacerbate the racial wealth gap.

The historic gap in Black land, or property, ownership directly correlates to the inability of Black student debt holders to own a home.

See Ch.2, the Data, for facts on the false choice descendants of enslaved people must make between higher education and homeownership.

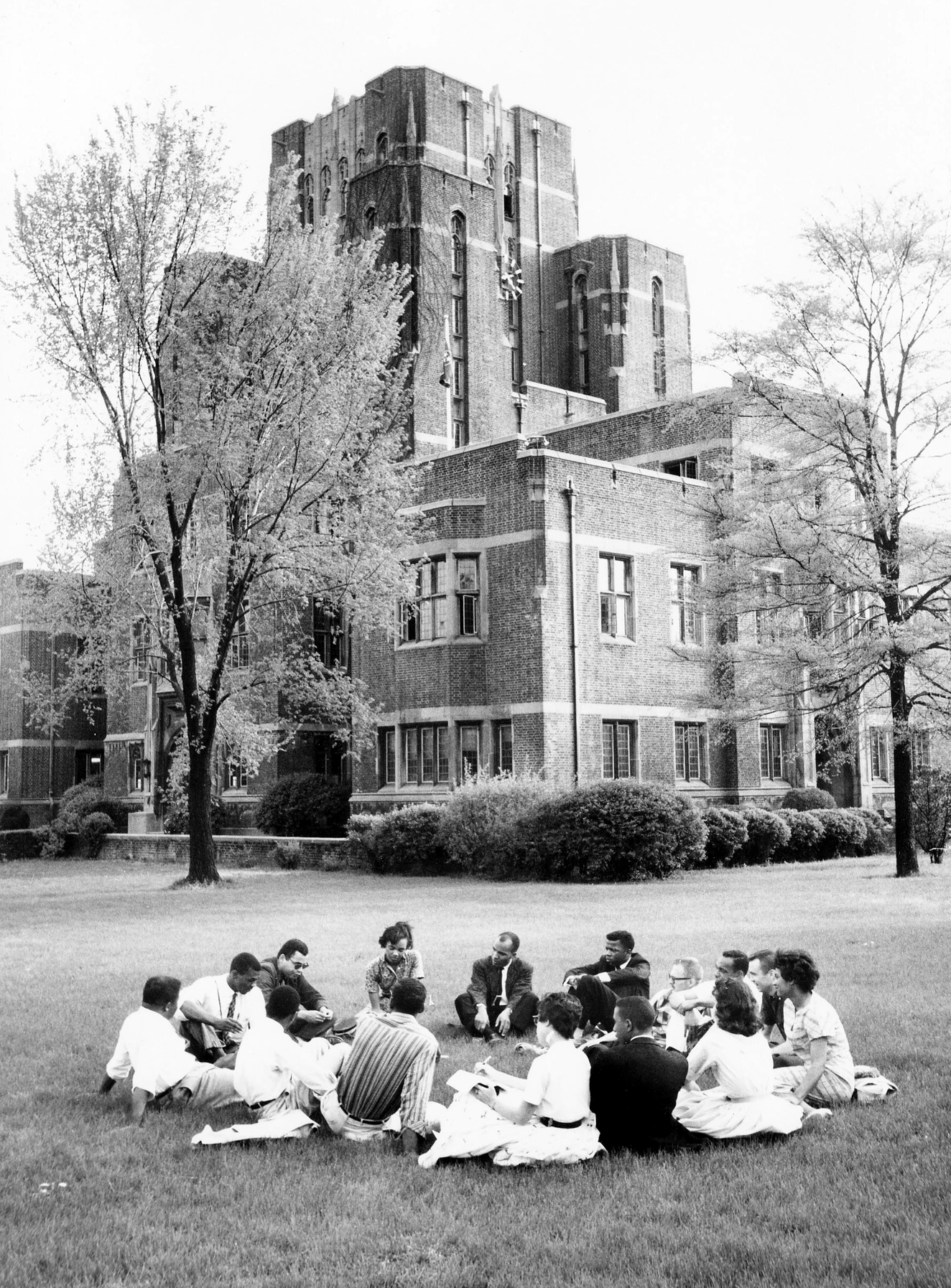

Higher Education:

20 years after starting college, the median student debt of White borrowers has been reduced by 94% whereas the median Black borrower still owes 95% of their student debt.

50% of Black graduates defaulted on their loans within the same period.

Wealth compounds; oppression compounds.

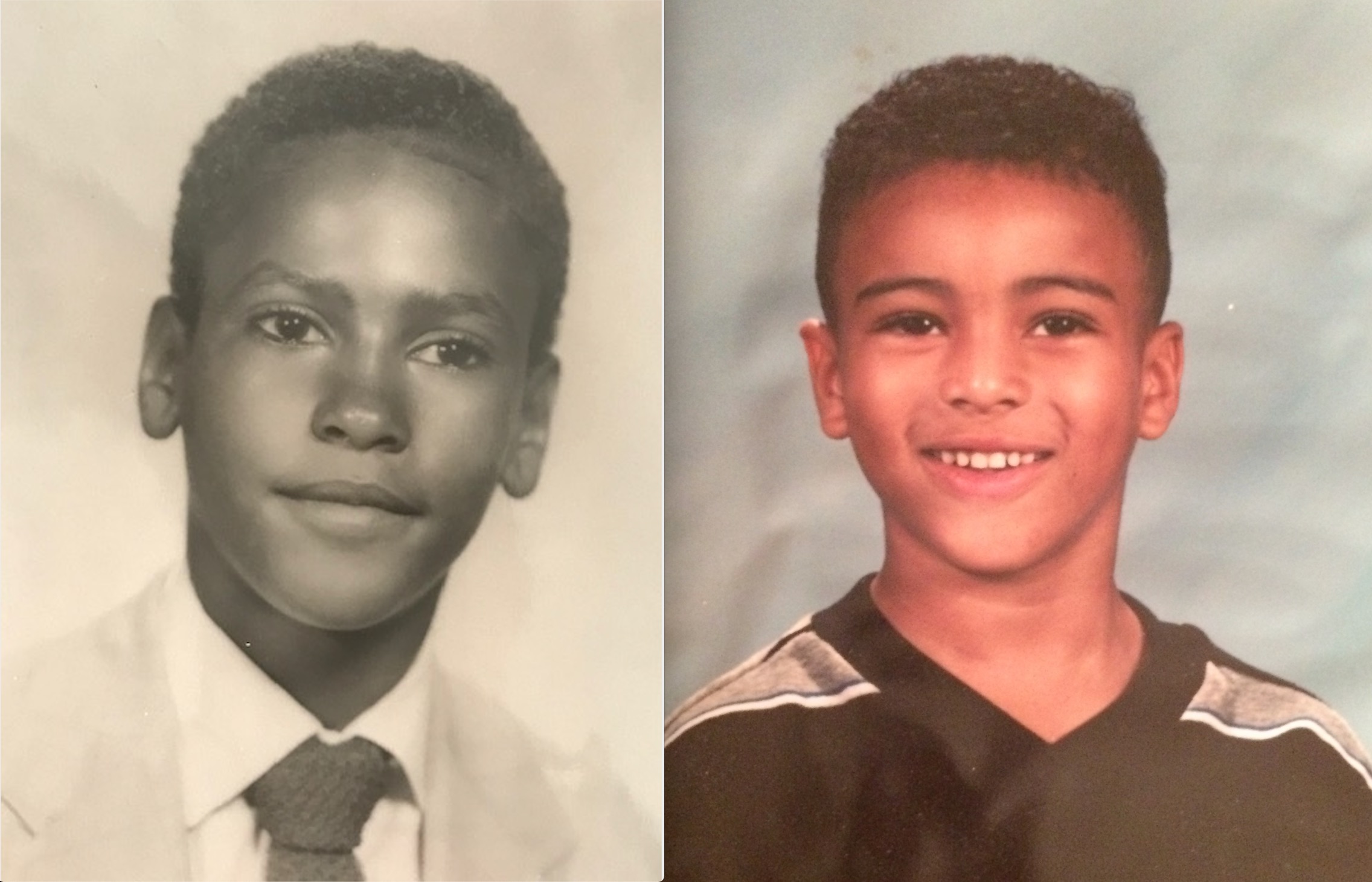

For four centuries, millions of enslaved people suffered callous injustice and incomparable wealth extraction. Restitution today represents a memento of justice for the unnamed.

Each Black American student represents

an incalculable sum of compounded oppression.

The Origins of Racial-Economic Inequity

12 of the first 18 U.S. Presidents were enslavers of kidnapped Black people.

The Trans-Atlantic Slave Trade Database cites 12.5 million Africans shipped on 35,000 shipping vessels to the New World between 1525 - 1866. 10.7 million survived the dreaded Middle Passage.

The 1860 U.S. Census documented 3,953,762 enslaved Black people, 13% of the U.S. population.

![]()

![]()

For over 200 years, the enslaved were held in bondage, unable to generate wealth for themselves, while quite literally building the foundation of the world’s richest economy.

The White House was, in fact, built by enslaved people. The U.S. government hired enslaved labor from slaveholders.

The Trans-Atlantic Slave Trade Database cites 12.5 million Africans shipped on 35,000 shipping vessels to the New World between 1525 - 1866. 10.7 million survived the dreaded Middle Passage.

The 1860 U.S. Census documented 3,953,762 enslaved Black people, 13% of the U.S. population.

For over 200 years, the enslaved were held in bondage, unable to generate wealth for themselves, while quite literally building the foundation of the world’s richest economy.

The White House was, in fact, built by enslaved people. The U.S. government hired enslaved labor from slaveholders.

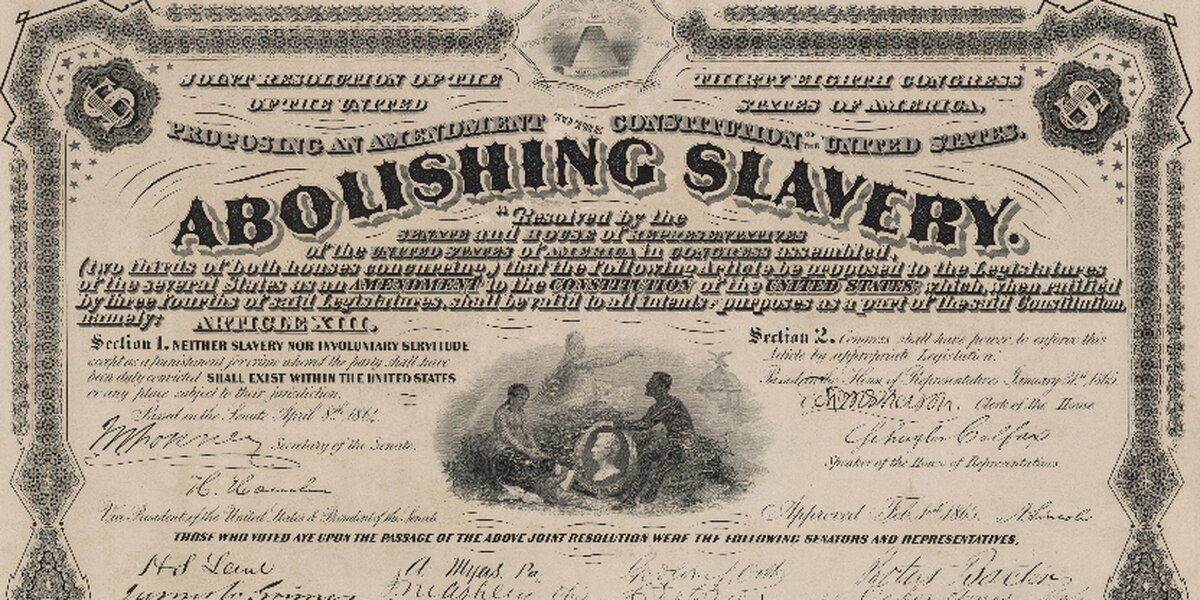

Reparations for Black enslavement were paid to White slaveholders through President Lincoln’s D.C. Emancipation Act (1862), but never to the millions of enslaved, or their descendants.

Slave owners were compensated up to $300 for every enslaved person.

$300 in 1862 is roughly $8,000 today.

The largest individual payout of reparations was for $18,000 for an enslaver who owned 69 enslaved people. $18,000 equates to roughly $475,937.82 in purchasing power today.

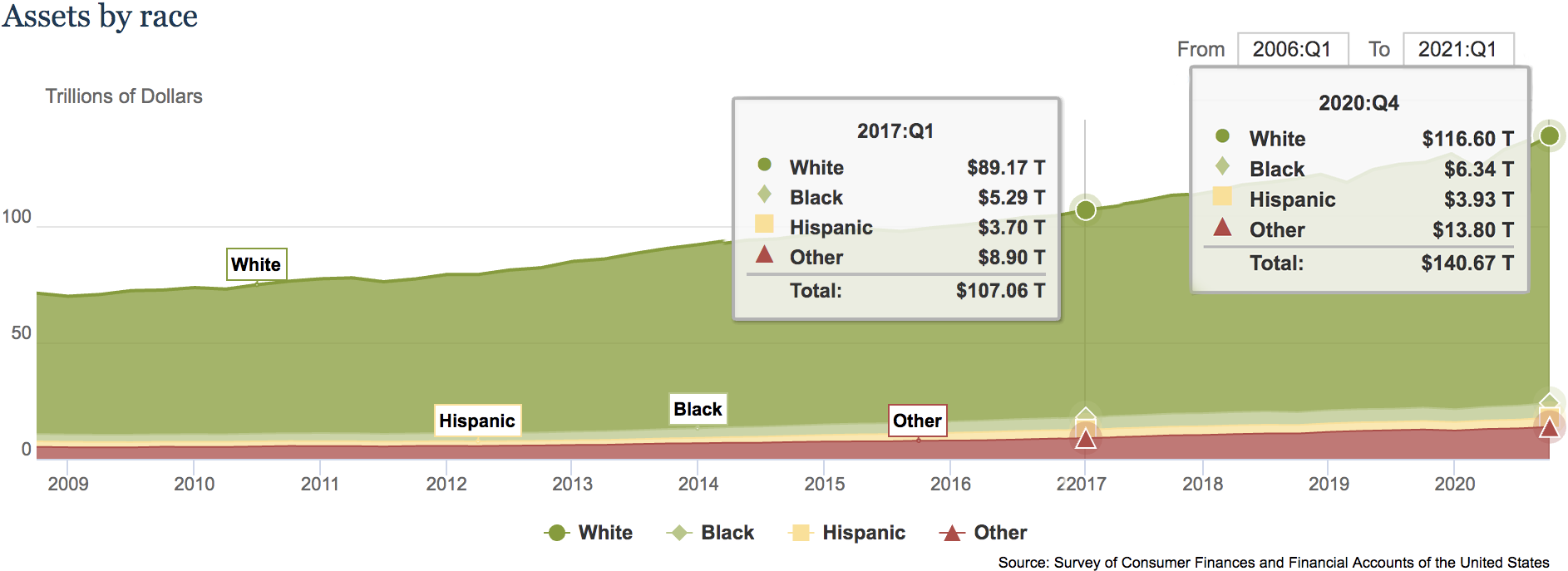

During the Trump administration,

White wealth grew by $25.8 trillion, while Black wealth grew by $1.05 trillion.

------------------------------

Income ≠ Wealth

“Income is unequal, but wealth is even more unequal”Income :

Income is money that an individual or business receives in exchange for providing labor, producing a good or service. Yearly income is the sum of payments received in a one year.

Individuals typically earn income through wages or salary. Harvard economists “believe that the solution to reducing income inequality, which is strongly tied to the wealth gap, is to close the educational divide.”

Wealth :

Wealth is the total of all assets held (homes, stocks, 401Ks) minus debts held (student loans.)

Wealth functions as a generational stepping stone. Future generations benefit from previous wealth and build onto it over time.

In 2020, Wealth functions as a generational stepping stone. Future generations benefit from previous wealth and build onto it over time.

White Americans held 83% ($116.6 trillion) of U.S. assetts,

Black Americans held 4.6% ($6.34 trillion).

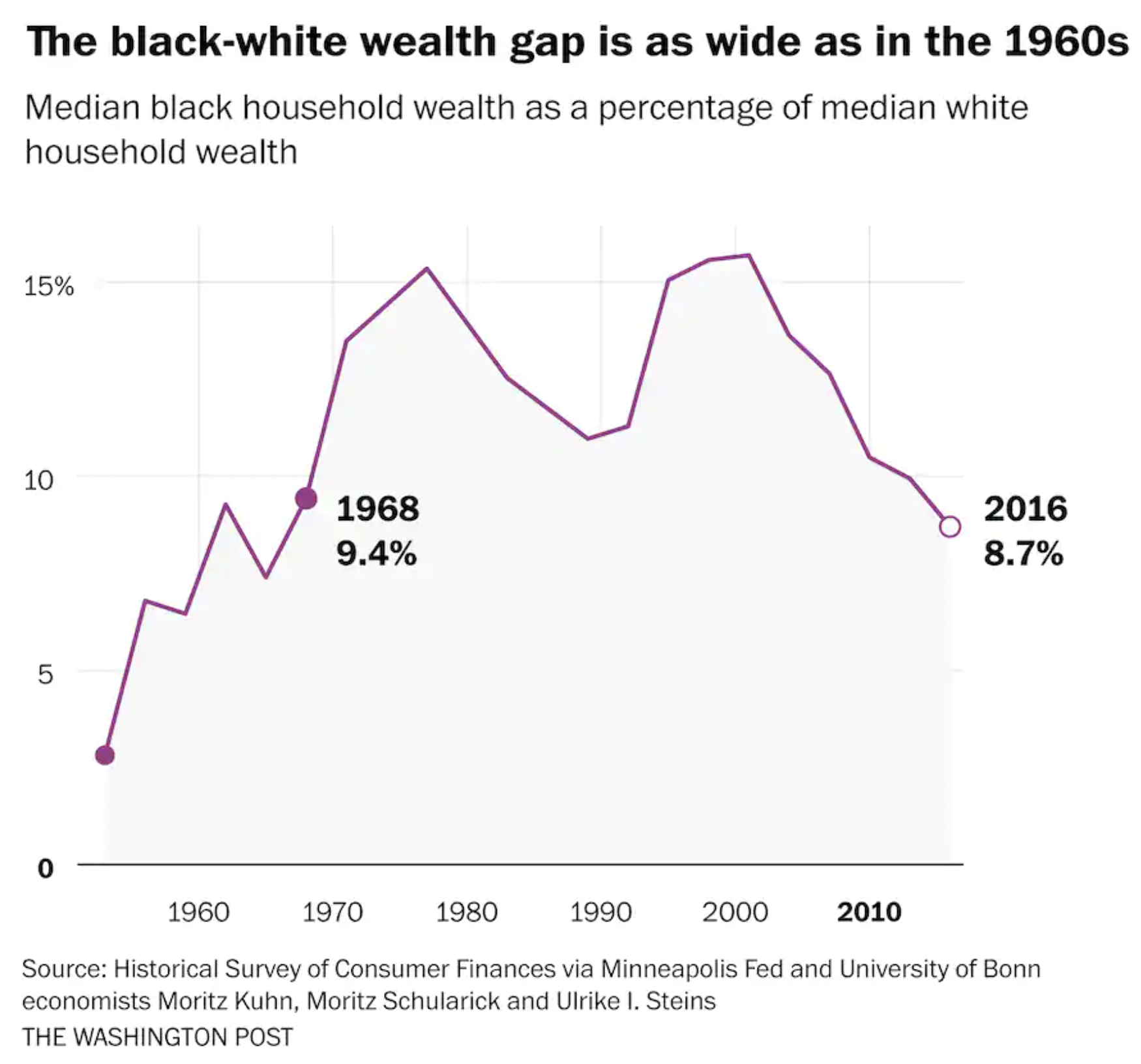

The Black-White economic divide is wider now than in 1968.

White American assets represent a sum 18x greater than Black American assets.

“Less Wealth & More Debt—lead to worse outcomes for Black students”

Wealth Gap :

For every $1 a typical White household has, a Black one has $0.12.

In 2016, typical White household wealth was 10x that of typical Black household wealth.

“ The 400 richest American billionaires have more wealth than all 10 million Black American households. ”

At best, typical Black household wealth was 15% of typical White household wealth. Racial discrimination in the labor market contribute to disparities in student debt.

Inheritance :

White families are 5x times more likely than Black families to receive large gifts or inheritances.

Inherited income is taxed less than 15% the average tax rate on income from work or savings. Economists Darrick Hamilton and Sandy Darity conclude that inheritances and other intergenerational transfers “account for more of the racial wealth gap than any other demographic and socioeconomic indicators.”

Land Ownership :

At United States’ founding, the right of land ownership was only extended to White men.

A 2002 (USDA) report, “Who Owns the Land?”, states that despite being 13% of the U.S. population, Black Americans held less than 1% of rural land in the country.

In 1999, that 1% share of Black land ownership accounted for a 7.75 million acres had a combined value of $14 billion.

White Americans, owned over 98% of U.S. land amounting to 856 million acres with a total worth over $1 trillion.

The 2017 Agriculture Census report showed Black Americans held roughly 4.7 million acres of rural land. A net loss of 3 million acres in less than 20 years.

(For exchange on agriculture disparities, begin at 04:30)

CNN founder Ted Turner owns over 2 million acres of land, equivalent to more than 40% of combined Black Americans rural land ownership.

America’s top three landowners John Malone, Ted Turner, and the Emmerson Family, own a combined 6.2 million acres of land, 32% more land than the combined total of 40 million Black Americans.

“The problem of wealth inequality is more extreme than income inequality since the former builds on the latter and their effects persists across generations.” - Economist, Lawerence Katz

Over 2 /3rds of Black borrowers have such high student debt burdens that they disqualify for standard Debt-to-Income (DTI) housing loan threshold maximums.

Conventional lenders prefer a DTI threshold of no more than 28%, while the FHA lending threshold suggests a DTI under 31%.

Typical Black yearly income: $43,600 (2019)

Outstanding student debt: $35,205

Monthly income: $3,633

Monthly student debt payment: $364.86

Mortgage + student debt payment: $1,497.55

Typical home cost: $272,446

Payment of $1,497.55, on a monthly income of $3,633 = DTI of 41.2%.

This suggests that the typical Black household could not afford a typical U.S. home priced at $272,446.

Conventional lenders prefer a DTI threshold of no more than 28%, while the FHA lending threshold suggests a DTI under 31%.

Typical Black yearly income: $43,600 (2019)

Outstanding student debt: $35,205

Monthly income: $3,633

Monthly student debt payment: $364.86

Mortgage + student debt payment: $1,497.55

Typical home cost: $272,446

Payment of $1,497.55, on a monthly income of $3,633 = DTI of 41.2%.

This suggests that the typical Black household could not afford a typical U.S. home priced at $272,446.

Without intervention, Black borrowers are cornered into choosing between pursuing higher education and homeownership.

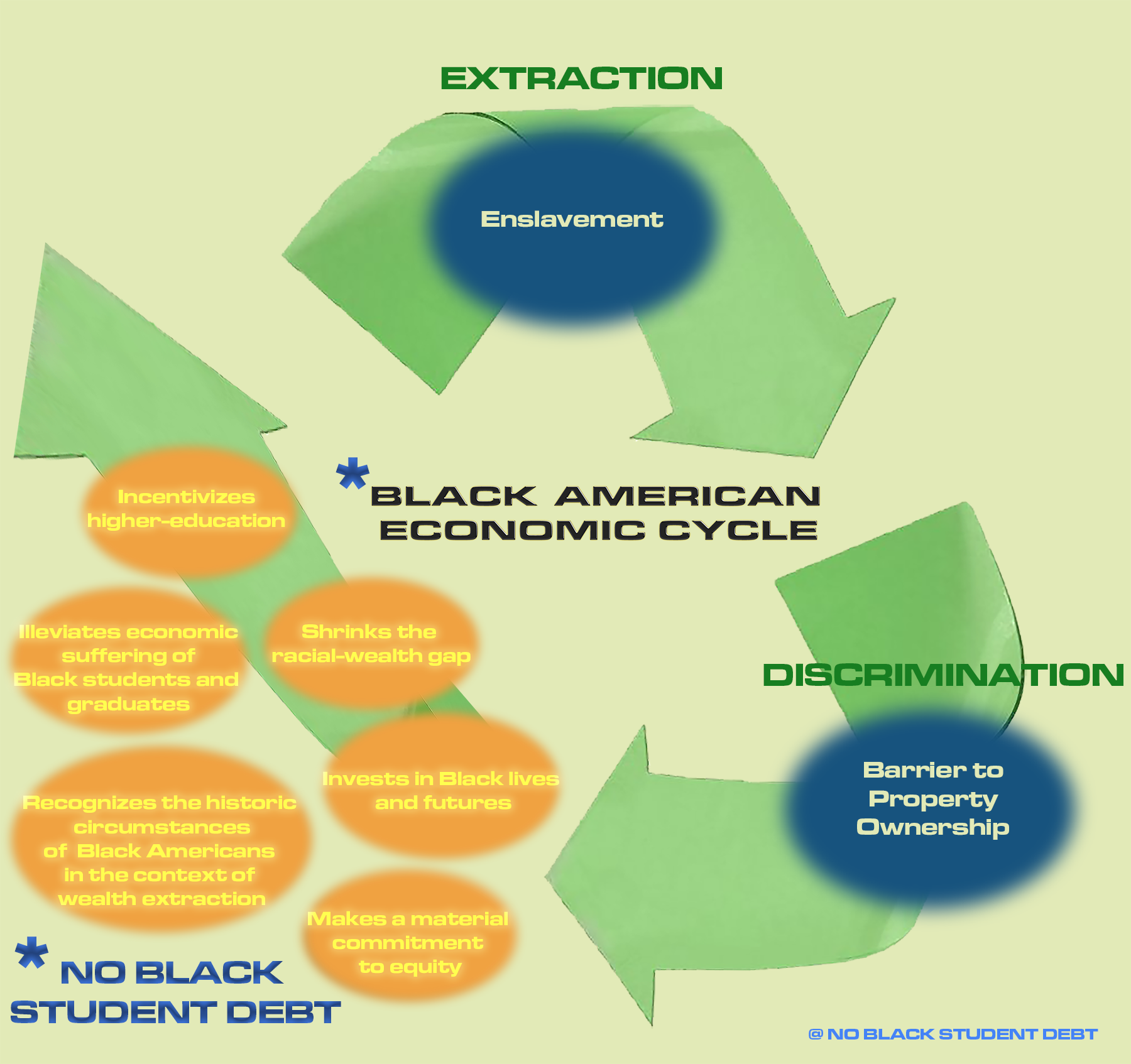

offers an actionable path towards addressing systemic racism based on materiality.

Participating institutions have an opportunity to set a national precedent and make material commitments to closing the racial wealth gap.

🌹

An inheritance of inequality :

Inequity infects all sectors of American life.

The U.S. is disadvantaged by its systemic discrimination. Citigroup estimates the U.S. economy lost $16 trillion over 20 years due to discrimination against Black Americans.

Structural change is the only way to address the myriad of inequities that humiliate American credibility internationally and thwart domestic unity across divides of race and wealth.

Enlightened Self-Interest :

It is within U.S. institutions long-term enlightened self-interest to excavate glaring inequities that materially benefit White Americans, while disadvantaging all others.

Symbolisim is an unsustainable approach for a nation that intends to compete in a fast-moving, globalized, 21st century. School over pirson.

The Federal Prison Industries program (trading as UNICOR) makes over $500 million annually in net sales using prison labor (with over 50% of sales going to the Defenese Department.)

UNICOR employs 17,000 inmates between 23¢ to $1.15 per hour to do eveything from “heavy manufacturing to computer-aided design.”

Since 2005, there has not been a nationwide census of prisons. It was estimated that there were nearly 1.5 million incarcerated people working, including 600,000 people in the manufacturing sector.

Race-Gender Pay Gap :

Black student debt is a gender justice issue.

In 2020, Black women earned $0.63 to every $1 of their White male counterparts.

Unsuprisingly, Black women have the largest student debt burden of any group in the U.S., proporationate to population.

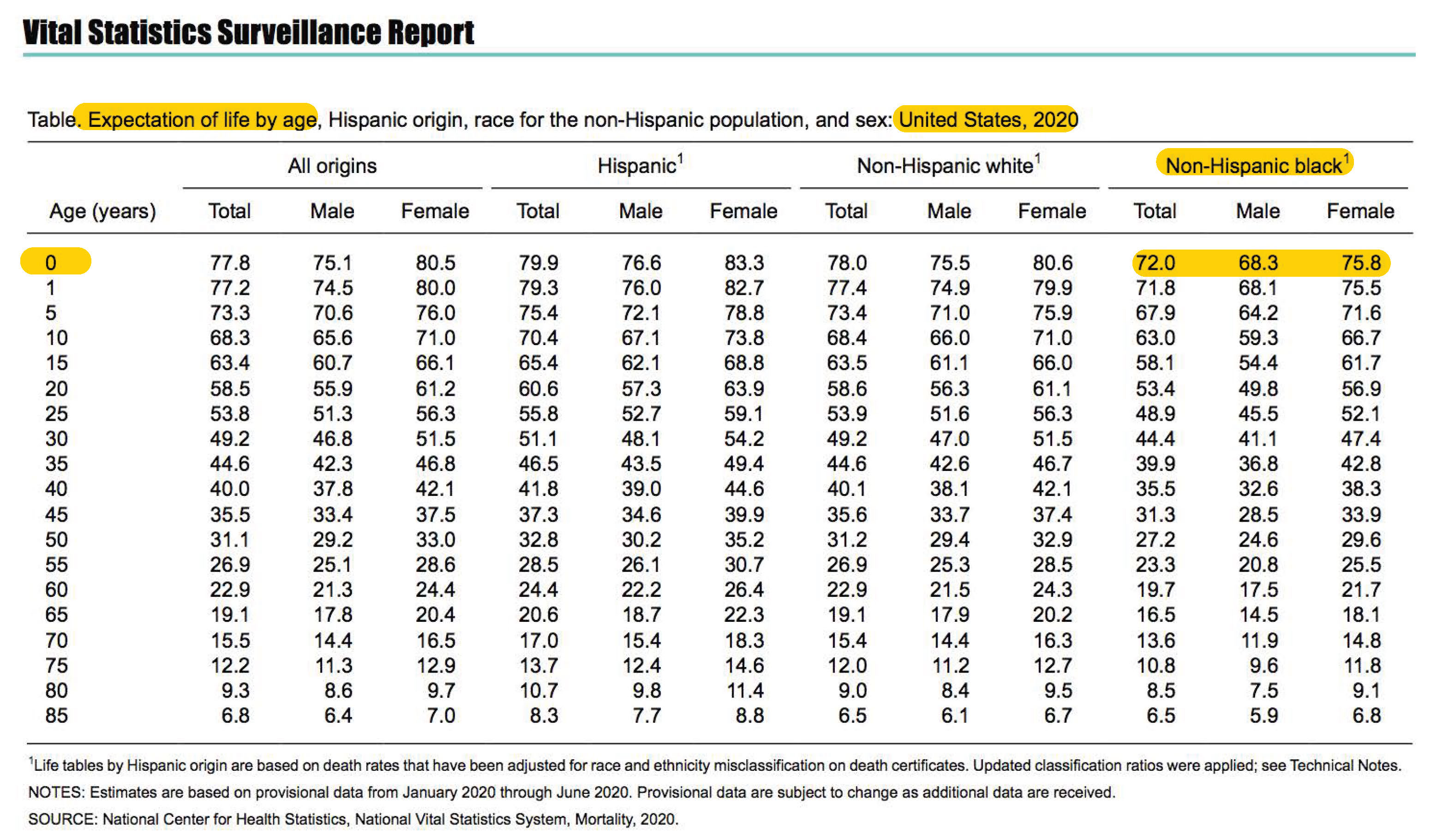

Black Life Expectancy :

The 2020 CDC Provisional Life Expectancy report states that Black life expectancy in the U.S. shrunk by 2.7 years in 2020.

Black males are the only demographic not expected to live to 70 years old.

Material solutions for material problems.

------------------------------The public sector has proven impotent at addressing systemic material inequities.

In 1998, Princeton University set precedent as the first university to offer full tuition remission to low-income students. Soon thereafter, other peer institutions followed suit.

Institutional action in the private sector is an opportunity to create a large-scale impact, influence national discourse, make history, ignite momentum, and build authentic partnerships between those working towards an equitable society.

One university, recognizes the injustice of Black student debt, can create a domino effect when one institution becomes the first to recognize the injustice of putting descendants of enslaved Black Americans in debt for education.

------------------------------

Eliminating Black student debt does the following :

- Alleviates suffering - finanical and emotional - of Black students and graduates

- Eases economic precarity and long-term financial insecurity

- Invests in Black lives and futues

- Shrinks the widening racial-wealth gap.

- Economically stimulates wealth-deprived communities

- Significantly shrinks Black debt-to-income (DTI) ratios, increasing probabilities for Black homeownership

- Incentivizes Black youth to pursue education

- Activates institutions as action-based change agents for an equitable society

- Makes material the public commitments to racial-economic equity

- Moves forward restitution for the descendants of millions of enslaved people

- Improves American viability in an increasingly competitive global marketplace

- Repairs American credibility by actioning policies move towards equity

- Recognizes the unique, historic, circumstances of Black Americans in the context of wealth extraction

Our generation can finally advance change.

By breaking the debt bondage cycle, we birth countless opportunities for the descendants of Black Americans to reach their potential.

Ch. 4 examines the cost of inaction.

Zero Black American Wealth in Three Decades :

The Institute for Policy Studies (IPS) warned in their 2017 report “The Road to Zero Wealth”,

“If the racial wealth divide is left unaddressed and is not exacerbated further over the next eight years, median Black household wealth is on a path to hit zero by 2053. In sharp contrast, median White household wealth would climb to $137,000 by 2053 and $147,000 by 2073.”

Before COVID-19’s disproportionate health and economic effects on Black Americans, the Pew Research Center released a report that emphasized the stark economic reality of the racial wealth gap. “In terms of their median net worth, White households are about 13x as wealthy as Black households – a gap that has grown wider since the Great Recession.”

The typical Black family whose head-of-household has a college diploma has less wealth than a white family whose dominant earner did not finish high school.

The Cost of Education :

The gap between four-year degree attainment between Black and White students is greater today than it was when the Higher Education Act was passed in 1965.

Since 1980, the average cost of four-year public college is up 1,200%, and 900% for private college, while inflation measured by the Consumer Price Index has risen by 236%.

Milennial Wealth Disparity :

The typical White millennial family has approx. $88,000 in wealth. The typical Black millennial family has approx. $5,000 in wealth.

White millennial wealth trails previous generations of White Americans by 5%, where Black millennial wealth trails previous generations of Black Americans by 52%.

Targeted Universalism :

If equity is the goal, then universal approaches alone are insufficient and can exacerbate current divides.

NBSD is a targeted strategy to shrink the widening racial wealth gap.

Our past is predetermined. Our future is not.

American history is not only one of suffering and injustice,

it’s also a history of profound transformation,

the blending of cultures that would forever change the world.

it’s also a history of profound transformation,

the blending of cultures that would forever change the world.

Without material intervention, or policy realizing the racial differences and the unique historic circumstances of Black Americans in context of wealth, Black Americans will face even steeper debt burdens to pursue education.

Race-blind or race-neutral education costs extracts finite financial resources from Black Americans, who have less wealth as evidenced by documentation in previous chapters. The effect of enormous education costs on a severely wealth-deprived communityhas left Black Americans spiraling downward in a cycle of disparities.

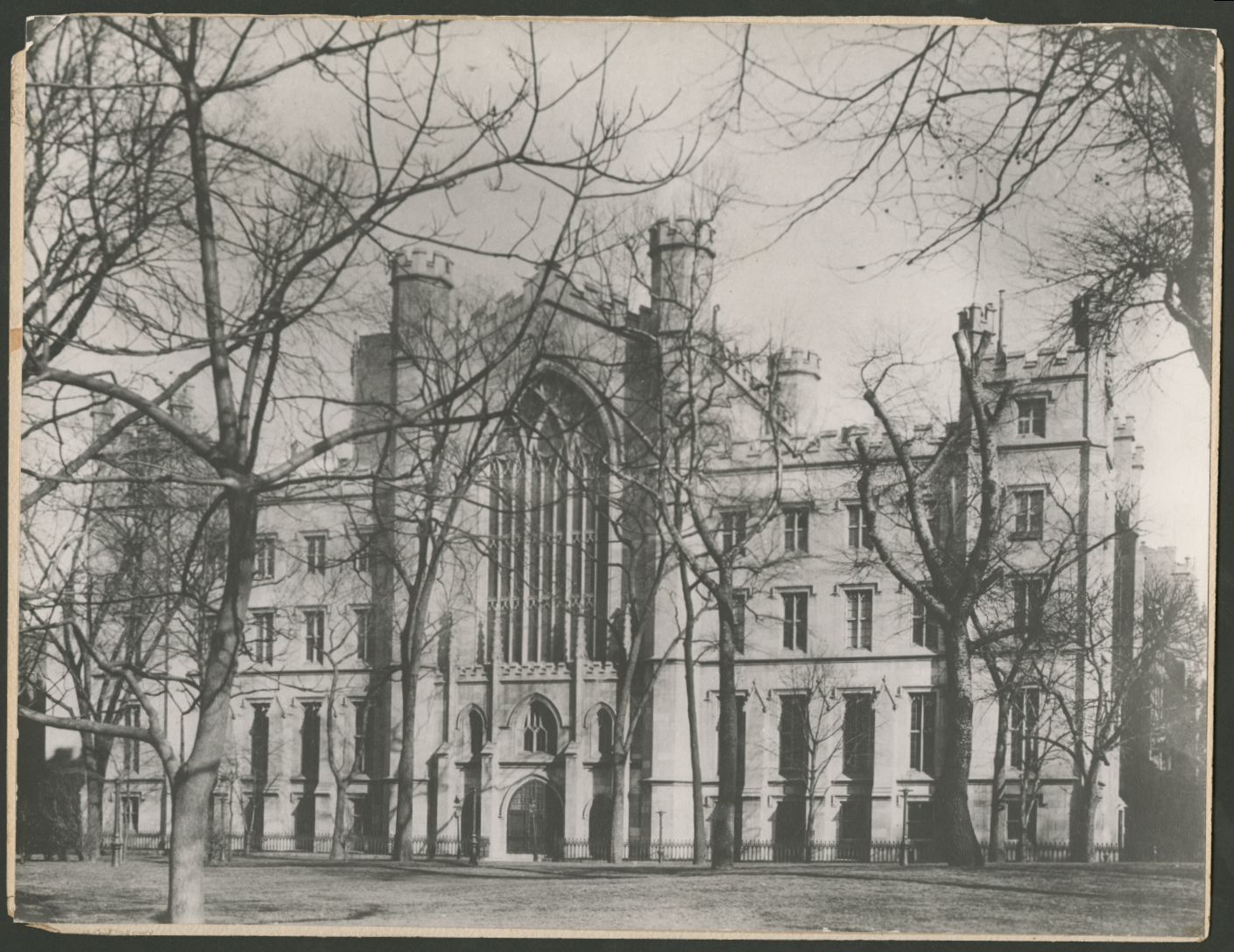

Chapter 05 : The New York University Case Study

See how NYU can afford to ensure that every Black NYU student begins their career with no student debt.

![]()

Race-blind or race-neutral education costs extracts finite financial resources from Black Americans, who have less wealth as evidenced by documentation in previous chapters. The effect of enormous education costs on a severely wealth-deprived communityhas left Black Americans spiraling downward in a cycle of disparities.

Chapter 05 : The New York University Case Study

See how NYU can afford to ensure that every Black NYU student begins their career with no student debt.

In 1831, NYU was founded. The same year,

states outlawed Blacks from reading and writing.

Slavery was abolished 25 years later.

“Any person or persons who shall attempt to teach any free person of color, or slave, to spell, read, or write, shall upon conviction thereof of the indictment be fined in a sum not less than $250.” ($250 equates to about $7,600 today) - 1833, an Alabama law

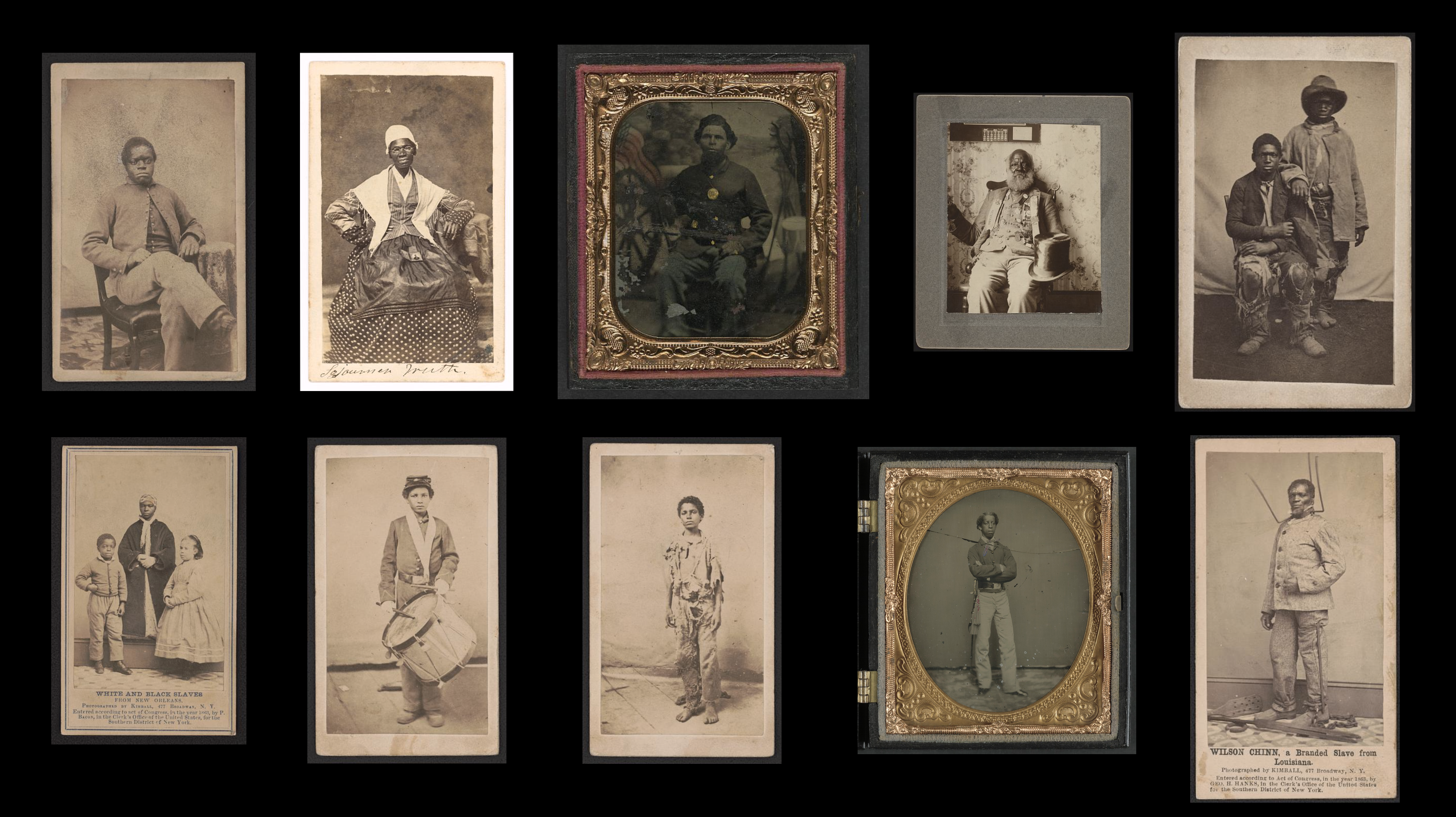

![Wilson Chinn, 1863]()

In 1863, at 477 Broadway, New York, NY, Wilson Chinn, a former enslaved person, was photographed with instruments of torture used on enslaved people.

The image intended to utilize the medium of photography to illustrate the depths of brutality existing in American slavery.

NYU’s campus is less than 1 mile from where Wilson Chinn’s photo was taken.

Demographic Trends :

Despite NYC’s 24.3% Black population,

Black students always account for less than 9% of NYU’s student body.

![]()

In 2018, NYU’s total Black student population was at 3,185, 6% of all students at NYU.

This single digit percentage remains despite a world-class community of extraordinary Black faculty and alumni including Ralph Ellison, Sonia Sanchez, Spike Lee, Ta-Nehisi Coates, Bryan Stevenson, Manthia Diawara, Mahershala Ali, Donald Glover, and MacArthur Genius Recipients Deborah Willis (00’) and Fred Moten (20’).

![]()

Despite NYC’s 24.3% Black population,

Black students always account for less than 9% of NYU’s student body.

In 2018, NYU’s total Black student population was at 3,185, 6% of all students at NYU.

This single digit percentage remains despite a world-class community of extraordinary Black faculty and alumni including Ralph Ellison, Sonia Sanchez, Spike Lee, Ta-Nehisi Coates, Bryan Stevenson, Manthia Diawara, Mahershala Ali, Donald Glover, and MacArthur Genius Recipients Deborah Willis (00’) and Fred Moten (20’).

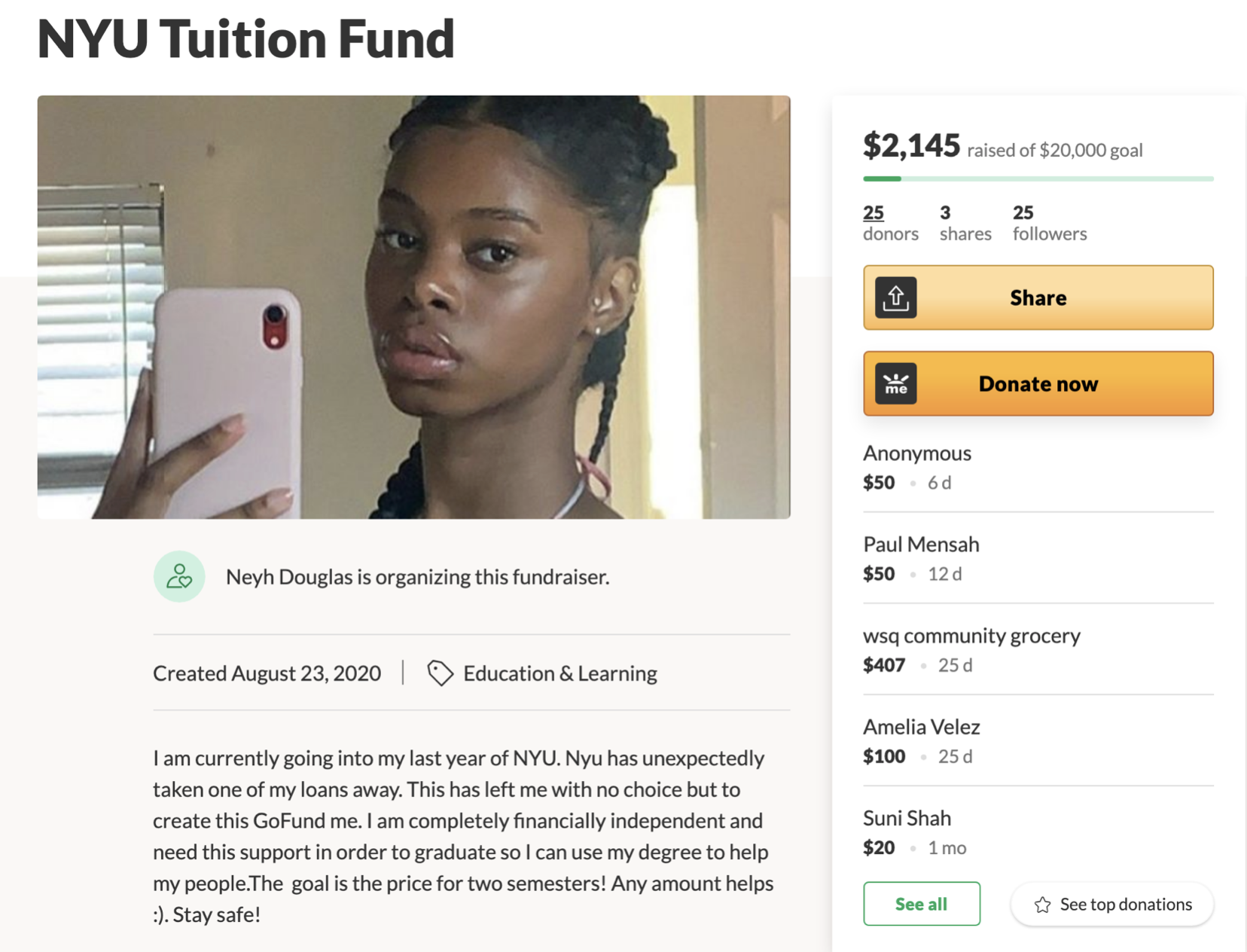

The Cost Black Communities Pay NYU :

2,317 Black students (7.8% of all students) paid $127,156,960 in tuition altogether.

In four years, this cohort will pay or borrow $503,627,840 in tuition to NYU.

Significant financial resources are extracted from a marginalized, disadvantaged, community to further enrich NYU.

Since 2020, U.S. lawmakers have passed six major bills costing $5.3 trillion with no significant student debt relief. To date, Biden has canceled $3 billion in student debt or 0.17% of the total debt.

In President Biden’s $6 trillion budget proposal, he omitted student debt-forgiveness.

Endowment Growth, Investing in Black Futures :

“ The Endowment’s objective is to support NYU students and faculty in the present and in the future ” - 2020 NYU Endowment Fact Sheet

7.6% annual growth for 20 years.

By NYU’s 2019 fiscal year-end, the Endowment Fund grew to $4.3 billion.

By NYU’s 2020 fiscal year-end, the Endowment Fund grew to $4.7 billion.

In 1 year, $400 million in net growth.

If the Endowment continues its 20-year trend, in August 2021, at the end of NYU’s fiscal year, the projected value of the Endowment will grow by $357 million for a total of approximately $5.05 billion.

7.6% annual growth for 20 years.

By NYU’s 2019 fiscal year-end, the Endowment Fund grew to $4.3 billion.

By NYU’s 2020 fiscal year-end, the Endowment Fund grew to $4.7 billion.

In 1 year, $400 million in net growth.

If the Endowment continues its 20-year trend, in August 2021, at the end of NYU’s fiscal year, the projected value of the Endowment will grow by $357 million for a total of approximately $5.05 billion.

There is a historic opportunity to set a standard of accountability and material investment, and to close the racial wealth gap.

Actioning No Black Student Debt :

Rectifying the Past :

A lump-sum payment to erase outstanding student debt burdens of Black NYU alumni. Qualifying alumni with outstanding loan burdens would be responsible for contacting NYU to have their balances relieved.

Investing in the Future :

Enact a racial justice and economic equity policy for full tuition remission for Black students of NYU. This waiver of tuition, eliminates Black students as a revenue source for NYU.