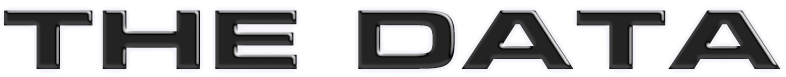

Wealth compounds; oppression compounds.

For four centuries, millions of enslaved people suffered callous injustice and incomparable wealth extraction. Restitution today represents a memento of justice for the unnamed.

Each Black American student represents

an incalculable sum of compounded oppression.

The Origins of Racial-Economic Inequity

12 of the first 18 U.S. Presidents were enslavers of kidnapped Black people.

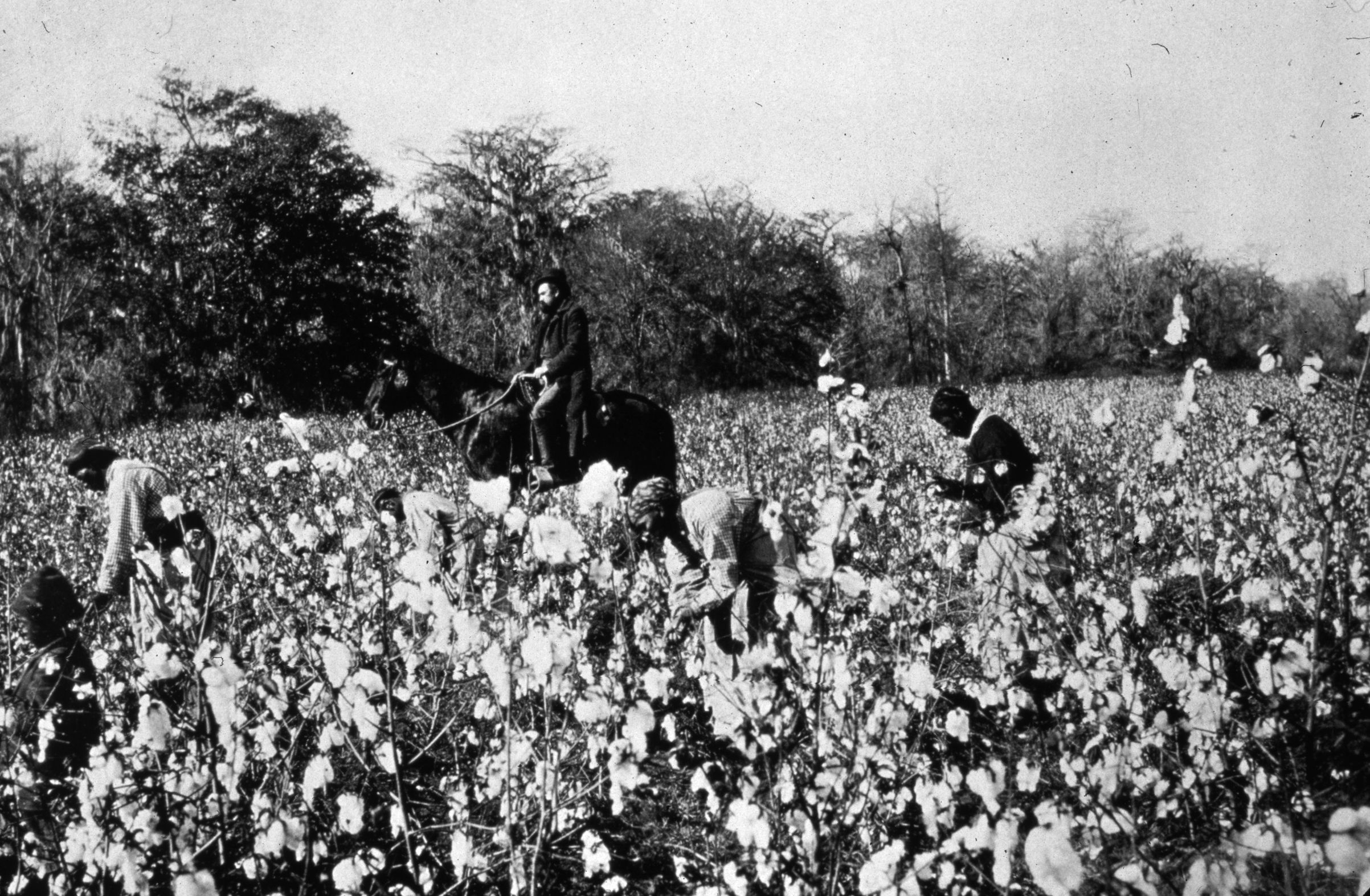

The Trans-Atlantic Slave Trade Database cites 12.5 million Africans shipped on 35,000 shipping vessels to the New World between 1525 - 1866. 10.7 million survived the dreaded Middle Passage.

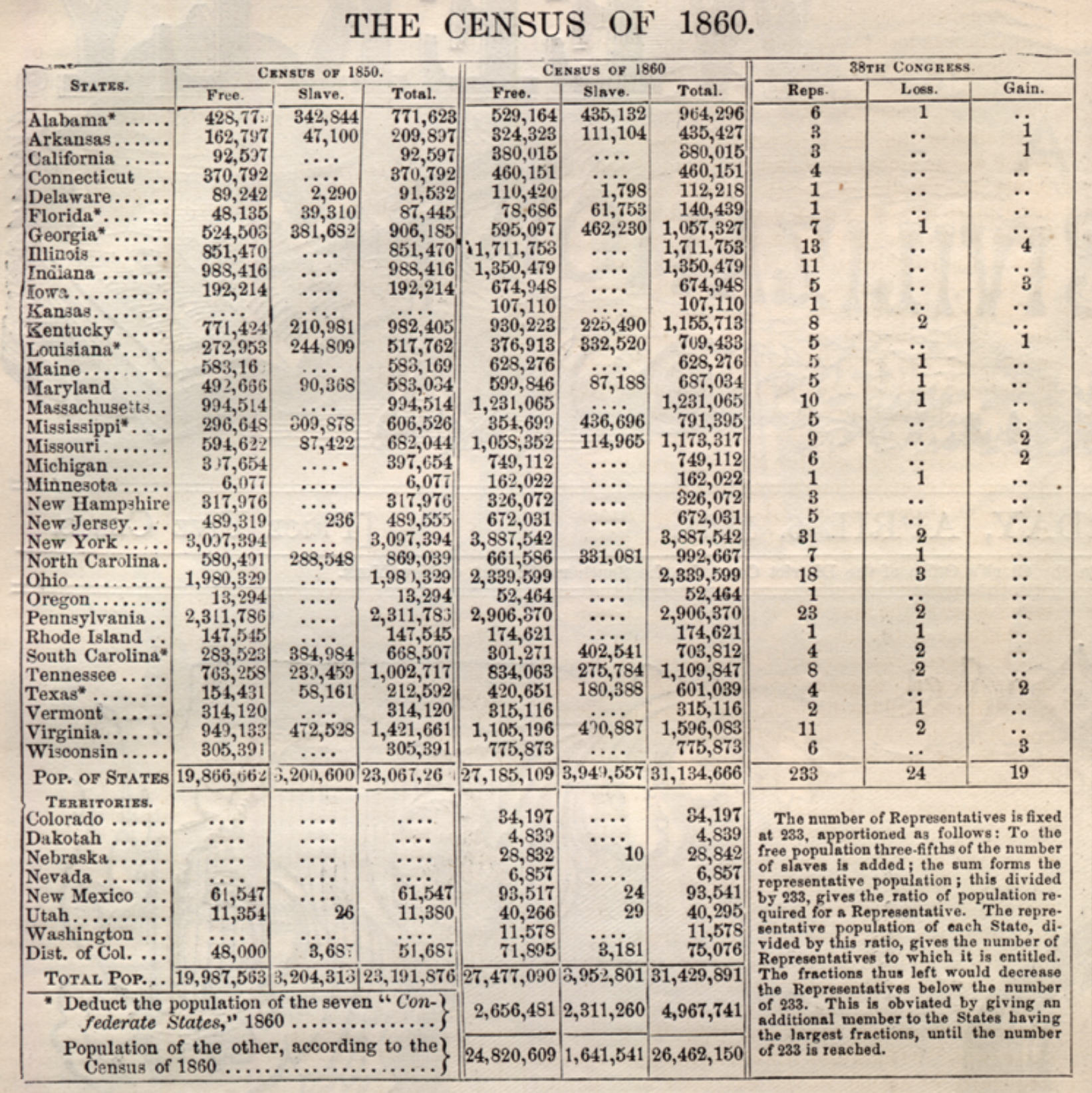

The 1860 U.S. Census documented 3,953,762 enslaved Black people, 13% of the U.S. population.

![]()

![]()

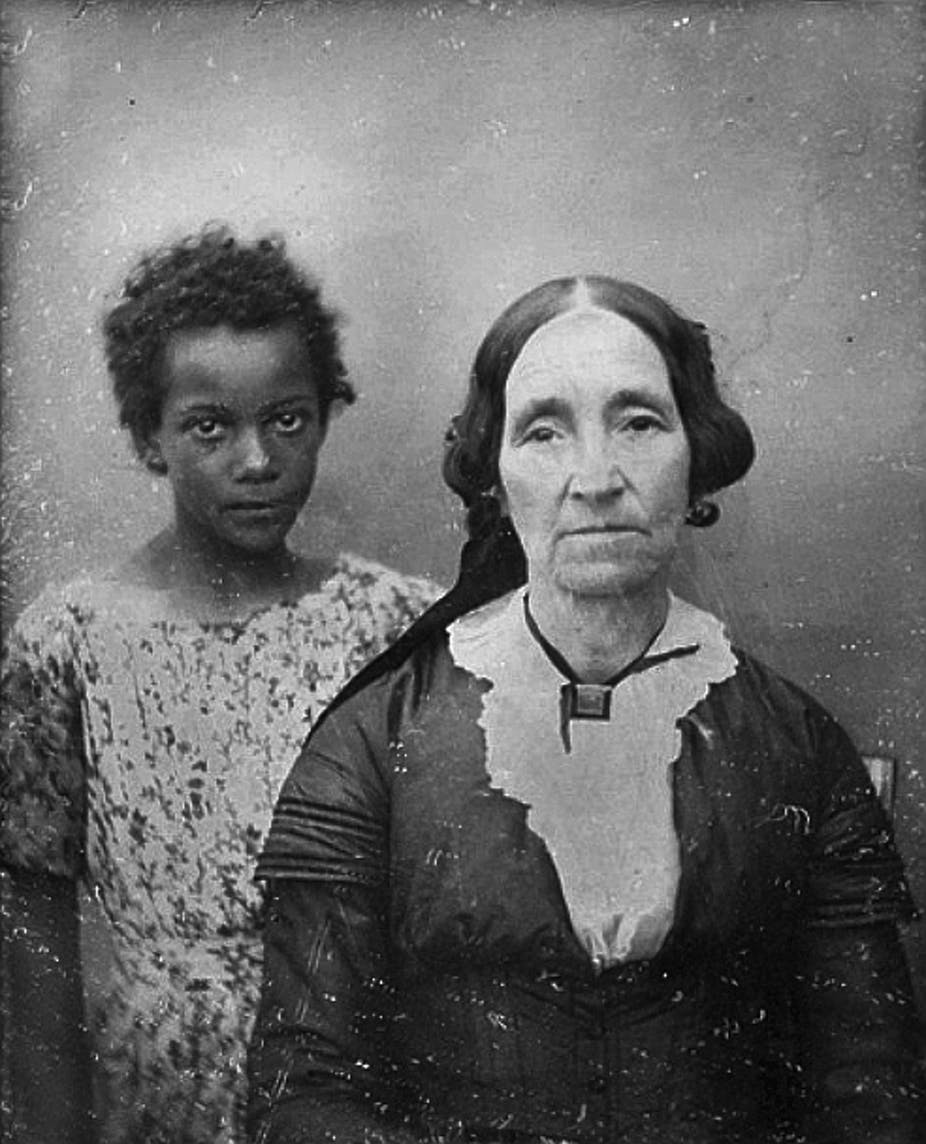

For over 200 years, the enslaved were held in bondage, unable to generate wealth for themselves, while quite literally building the foundation of the world’s richest economy.

The White House was, in fact, built by enslaved people. The U.S. government hired enslaved labor from slaveholders.

The Trans-Atlantic Slave Trade Database cites 12.5 million Africans shipped on 35,000 shipping vessels to the New World between 1525 - 1866. 10.7 million survived the dreaded Middle Passage.

The 1860 U.S. Census documented 3,953,762 enslaved Black people, 13% of the U.S. population.

For over 200 years, the enslaved were held in bondage, unable to generate wealth for themselves, while quite literally building the foundation of the world’s richest economy.

The White House was, in fact, built by enslaved people. The U.S. government hired enslaved labor from slaveholders.

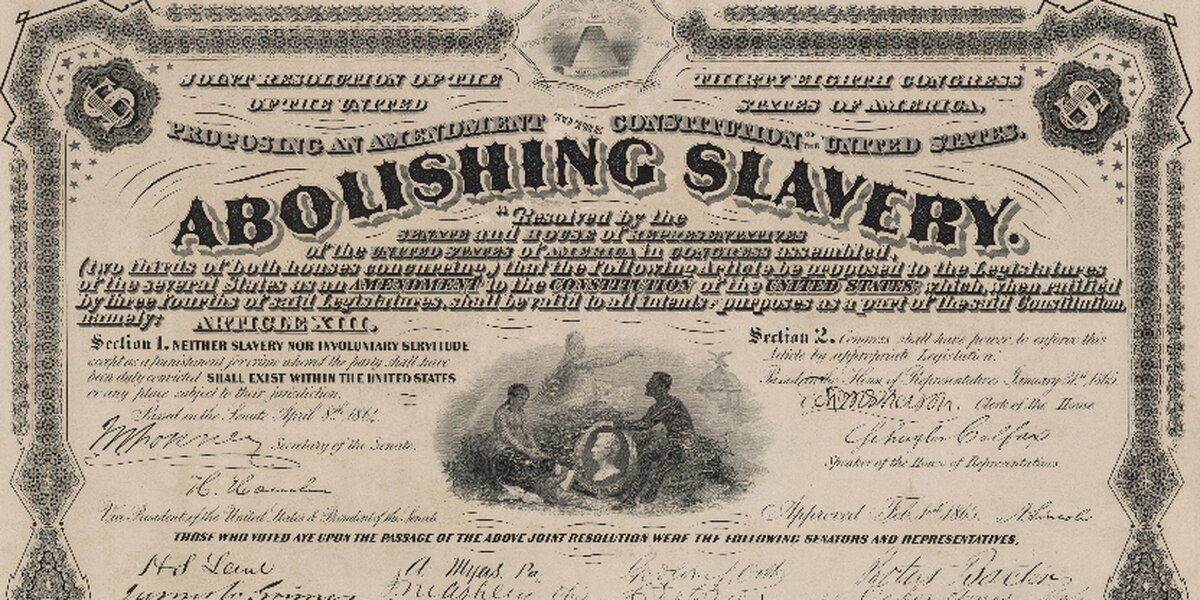

Reparations for Black enslavement were paid to White slaveholders through President Lincoln’s D.C. Emancipation Act (1862), but never to the millions of enslaved, or their descendants.

Slave owners were compensated up to $300 for every enslaved person.

$300 in 1862 is roughly $8,000 today.

The largest individual payout of reparations was for $18,000 for an enslaver who owned 69 enslaved people. $18,000 equates to roughly $475,937.82 in purchasing power today.

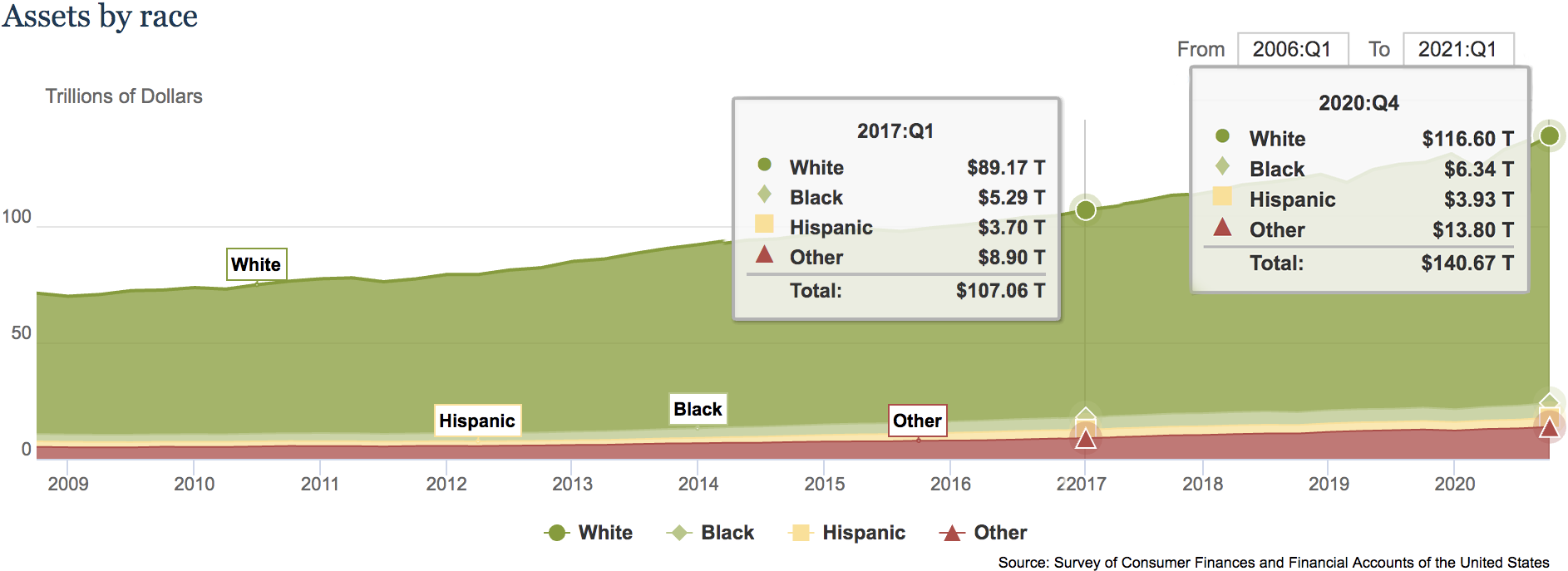

During the Trump administration,

White wealth grew by $25.8 trillion, while Black wealth grew by $1.05 trillion.

------------------------------

Income ≠ Wealth

“Income is unequal, but wealth is even more unequal”Income :

Income is money that an individual or business receives in exchange for providing labor, producing a good or service. Yearly income is the sum of payments received in a one year.

Individuals typically earn income through wages or salary. Harvard economists “believe that the solution to reducing income inequality, which is strongly tied to the wealth gap, is to close the educational divide.”

Wealth :

Wealth is the total of all assets held (homes, stocks, 401Ks) minus debts held (student loans.)

Wealth functions as a generational stepping stone. Future generations benefit from previous wealth and build onto it over time.

In 2020, Wealth functions as a generational stepping stone. Future generations benefit from previous wealth and build onto it over time.

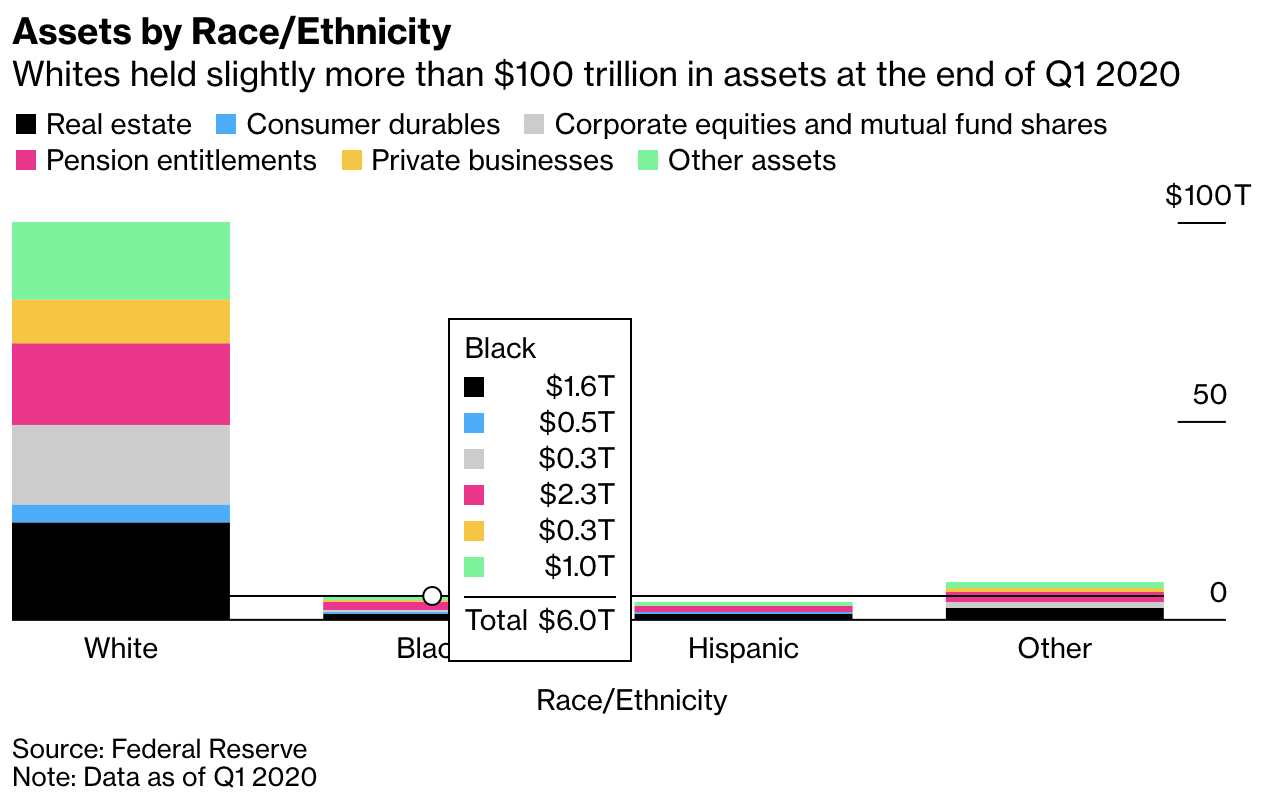

White Americans held 83% ($116.6 trillion) of U.S. assetts,

Black Americans held 4.6% ($6.34 trillion).

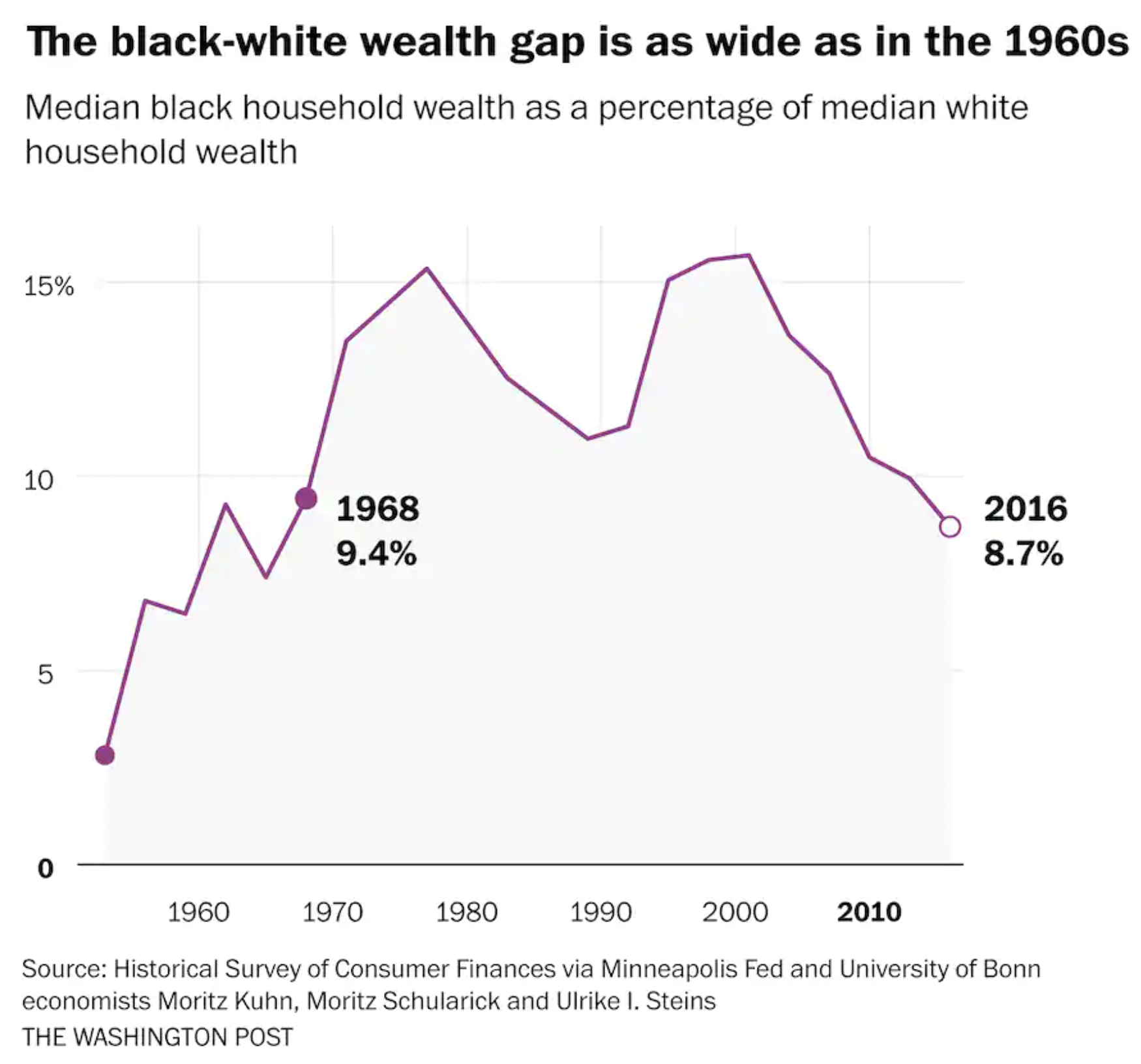

The Black-White economic divide is wider now than in 1968.

White American assets represent a sum 18x greater than Black American assets.

“Less Wealth & More Debt—lead to worse outcomes for Black students”

Wealth Gap :

For every $1 a typical White household has, a Black one has $0.12.

In 2016, typical White household wealth was 10x that of typical Black household wealth.

“ The 400 richest American billionaires have more wealth than all 10 million Black American households. ”

At best, typical Black household wealth was 15% of typical White household wealth. Racial discrimination in the labor market contribute to disparities in student debt.

Inheritance :

White families are 5x times more likely than Black families to receive large gifts or inheritances.

Inherited income is taxed less than 15% the average tax rate on income from work or savings. Economists Darrick Hamilton and Sandy Darity conclude that inheritances and other intergenerational transfers “account for more of the racial wealth gap than any other demographic and socioeconomic indicators.”

Land Ownership :

At United States’ founding, the right of land ownership was only extended to White men.

A 2002 (USDA) report, “Who Owns the Land?”, states that despite being 13% of the U.S. population, Black Americans held less than 1% of rural land in the country.

In 1999, that 1% share of Black land ownership accounted for a 7.75 million acres had a combined value of $14 billion.

White Americans, owned over 98% of U.S. land amounting to 856 million acres with a total worth over $1 trillion.

The 2017 Agriculture Census report showed Black Americans held roughly 4.7 million acres of rural land. A net loss of 3 million acres in less than 20 years.

(For exchange on agriculture disparities, begin at 04:30)

CNN founder Ted Turner owns over 2 million acres of land, equivalent to more than 40% of combined Black Americans rural land ownership.

America’s top three landowners John Malone, Ted Turner, and the Emmerson Family, own a combined 6.2 million acres of land, 32% more land than the combined total of 40 million Black Americans.

“The problem of wealth inequality is more extreme than income inequality since the former builds on the latter and their effects persists across generations.” - Economist, Lawerence Katz

Over 2 /3rds of Black borrowers have such high student debt burdens that they disqualify for standard Debt-to-Income (DTI) housing loan threshold maximums.

Conventional lenders prefer a DTI threshold of no more than 28%, while the FHA lending threshold suggests a DTI under 31%.

Typical Black yearly income: $43,600 (2019)

Outstanding student debt: $35,205

Monthly income: $3,633

Monthly student debt payment: $364.86

Mortgage + student debt payment: $1,497.55

Typical home cost: $272,446

Payment of $1,497.55, on a monthly income of $3,633 = DTI of 41.2%.

This suggests that the typical Black household could not afford a typical U.S. home priced at $272,446.

Conventional lenders prefer a DTI threshold of no more than 28%, while the FHA lending threshold suggests a DTI under 31%.

Typical Black yearly income: $43,600 (2019)

Outstanding student debt: $35,205

Monthly income: $3,633

Monthly student debt payment: $364.86

Mortgage + student debt payment: $1,497.55

Typical home cost: $272,446

Payment of $1,497.55, on a monthly income of $3,633 = DTI of 41.2%.

This suggests that the typical Black household could not afford a typical U.S. home priced at $272,446.

Without intervention, Black borrowers are cornered into choosing between pursuing higher education and homeownership.