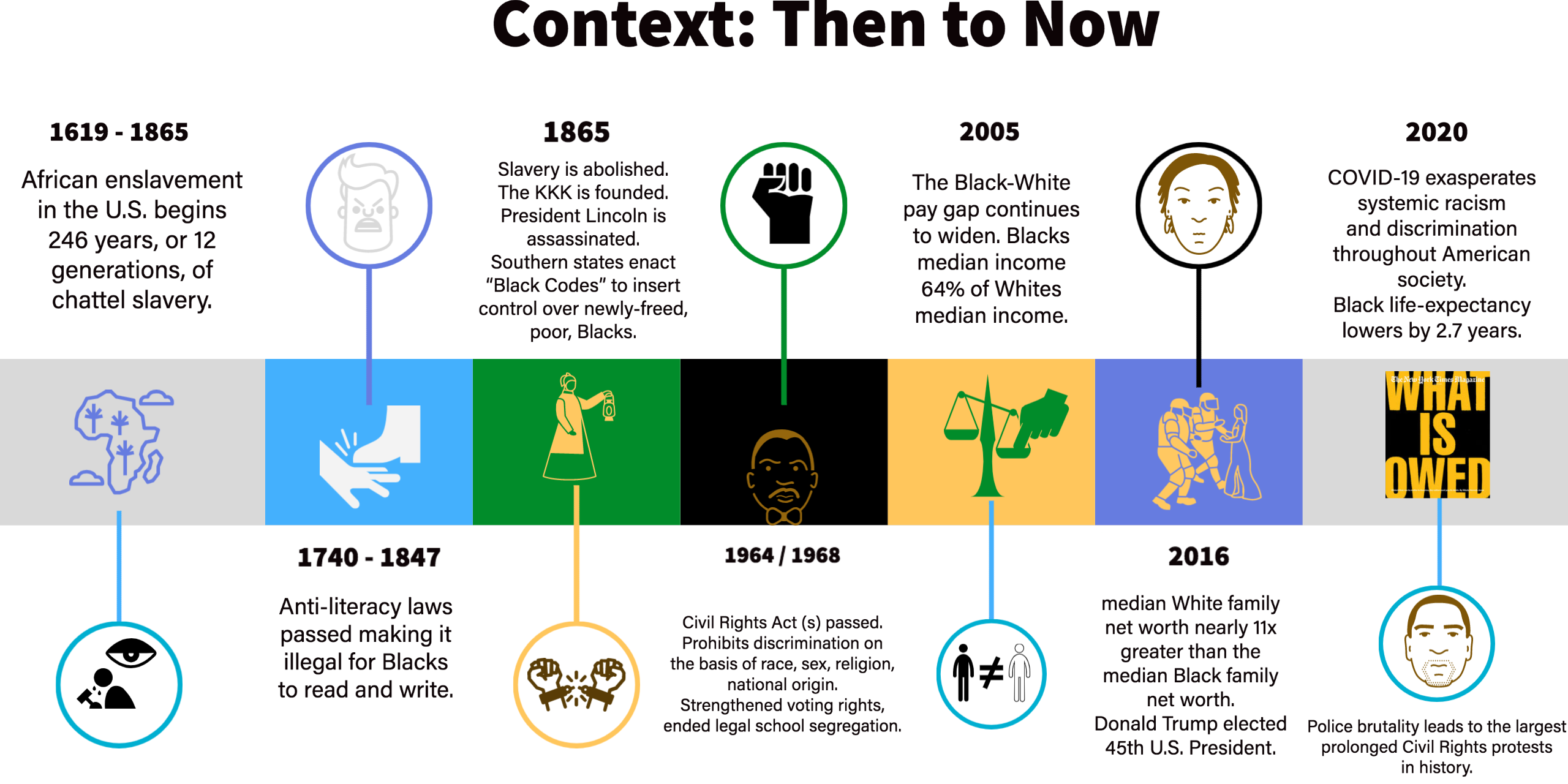

235 years of enslavement and forced labor,

100 years of Jim Crow discrimination,

65 years of denial and inaction around entrenched systemic prejudice.

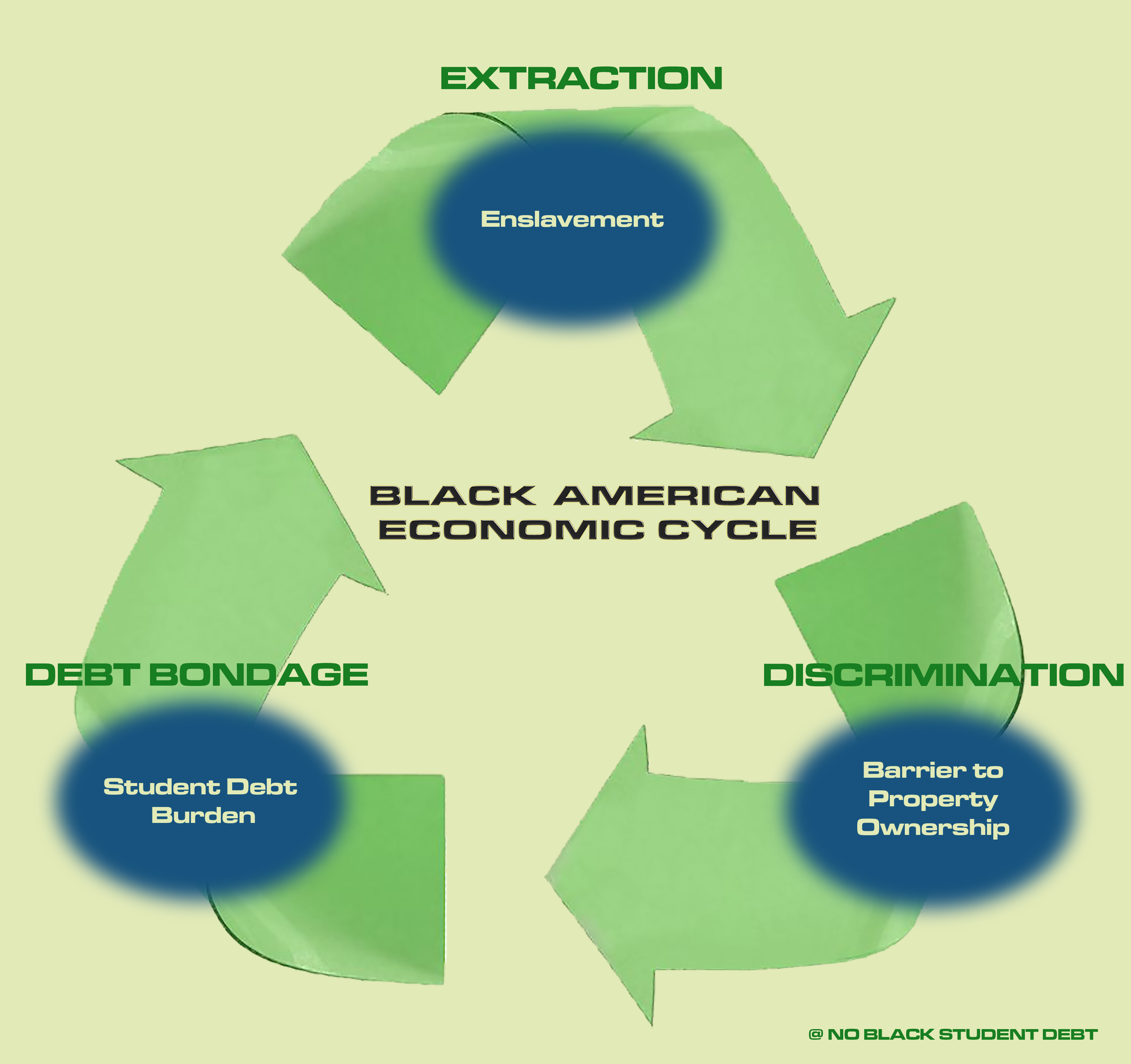

Property ownership and higher education are two primary sources

of wealth creation and upward social mobility America.

For 400 years, Black Americans have been systemically excluded from both.

Enslaved Black Americans were the largest financial asset in the United States. By 1860, there were more millionaires (all slaveholders) living in the lower Mississippi Valley than anywhere else in the U.S.

![Cotton by Justice Nnanna]()

The nearly 4 million enslaved people were worth some $3.5 billion, making them the largest single financial asset in the entire U.S. economy, worth more than all manufacturing and railroads combined.

Post-slavery newly freed enslaved people with no wealth became sharecroppers, laboring for a place to live, earning little, or no, money.

The nearly 4 million enslaved people were worth some $3.5 billion, making them the largest single financial asset in the entire U.S. economy, worth more than all manufacturing and railroads combined.

Post-slavery newly freed enslaved people with no wealth became sharecroppers, laboring for a place to live, earning little, or no, money.

Black Americans are the descendants of a 400 year legacy of rampant structural wealth extraction.

American Slavery and subsequent legal discrimination have extracted humanity and funneled significant economic gains away from Black Americans.

As cotton was the leading American export from 1803-1937 - U.S. continued to profit off of free, and cheap, Black labor.

As cotton was the leading American export from 1803-1937 - U.S. continued to profit off of free, and cheap, Black labor.

“Cotton cloth itself had become the most important merchandise European traders used to buy slaves in Africa. Planters discovered that climate and rainfall made the Deep South better cotton territory than the border states. Nearly a million American slaves were forcibly moved to Georgia, Mississippi and elsewhere, shattering many families in the process.”

- ‘Empire of Cotton,’ by Sven Beckert

This historic wealth extraction has exasperated the racial wealth gap, resulting in a crisis of Black student debt.

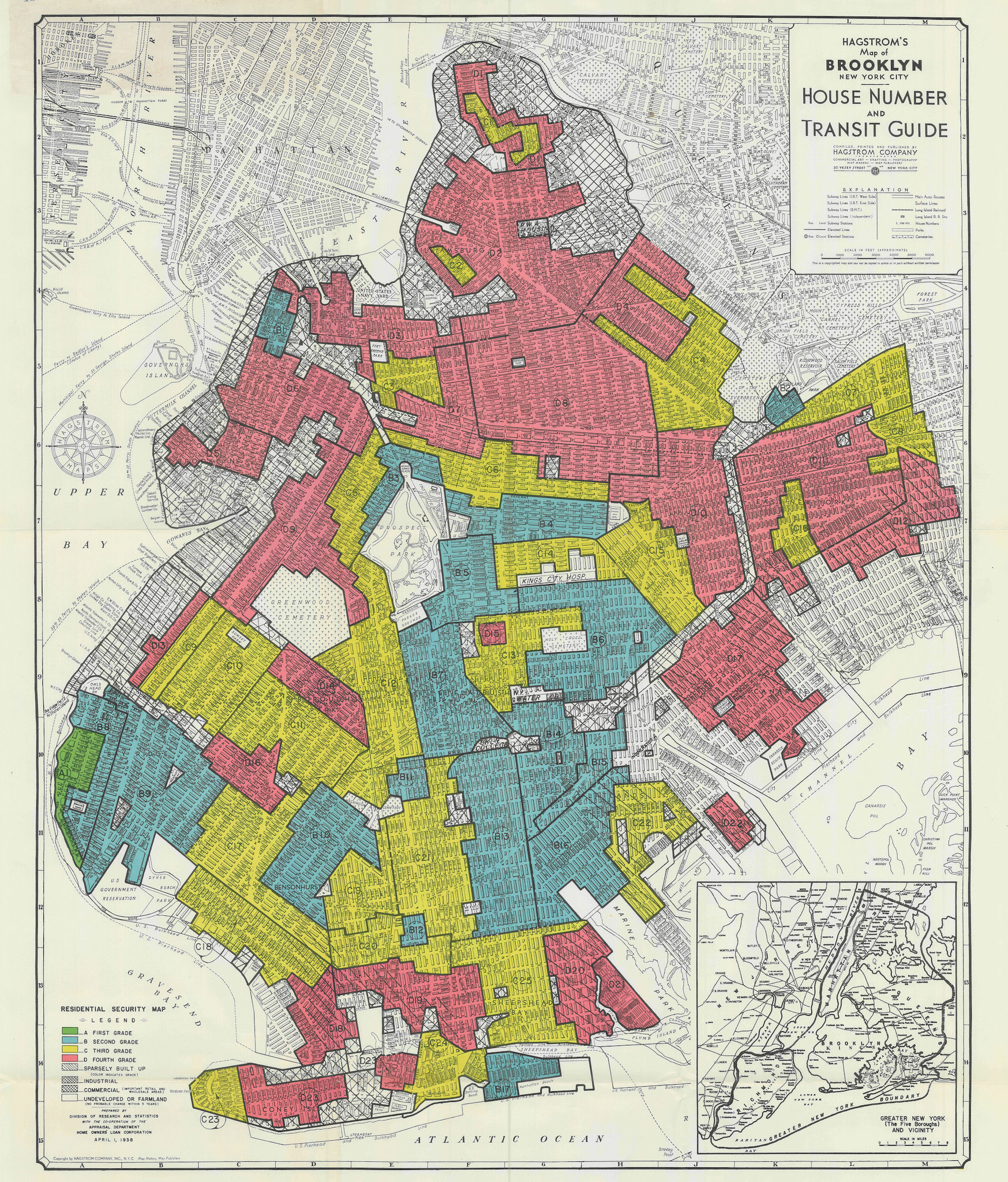

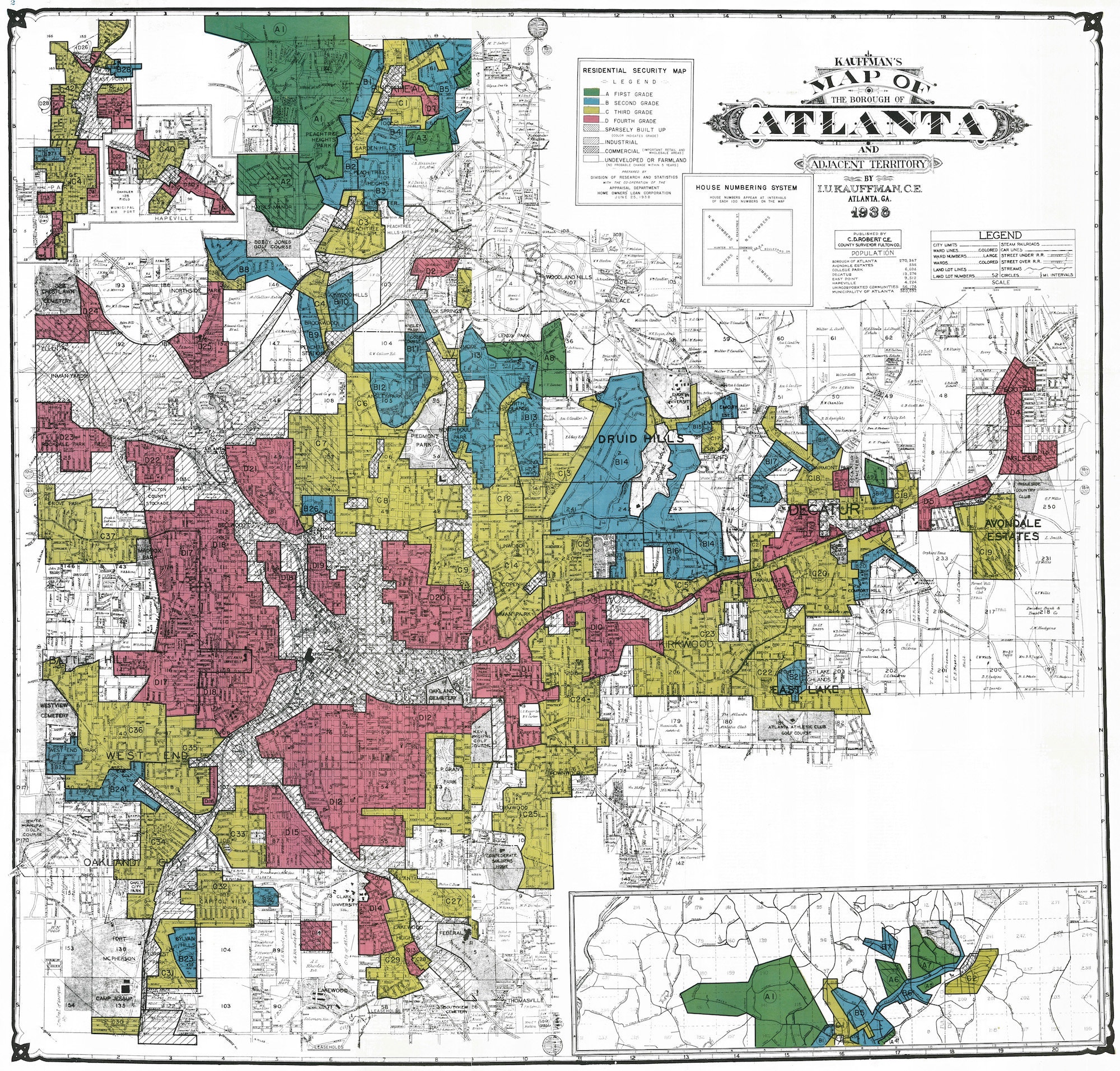

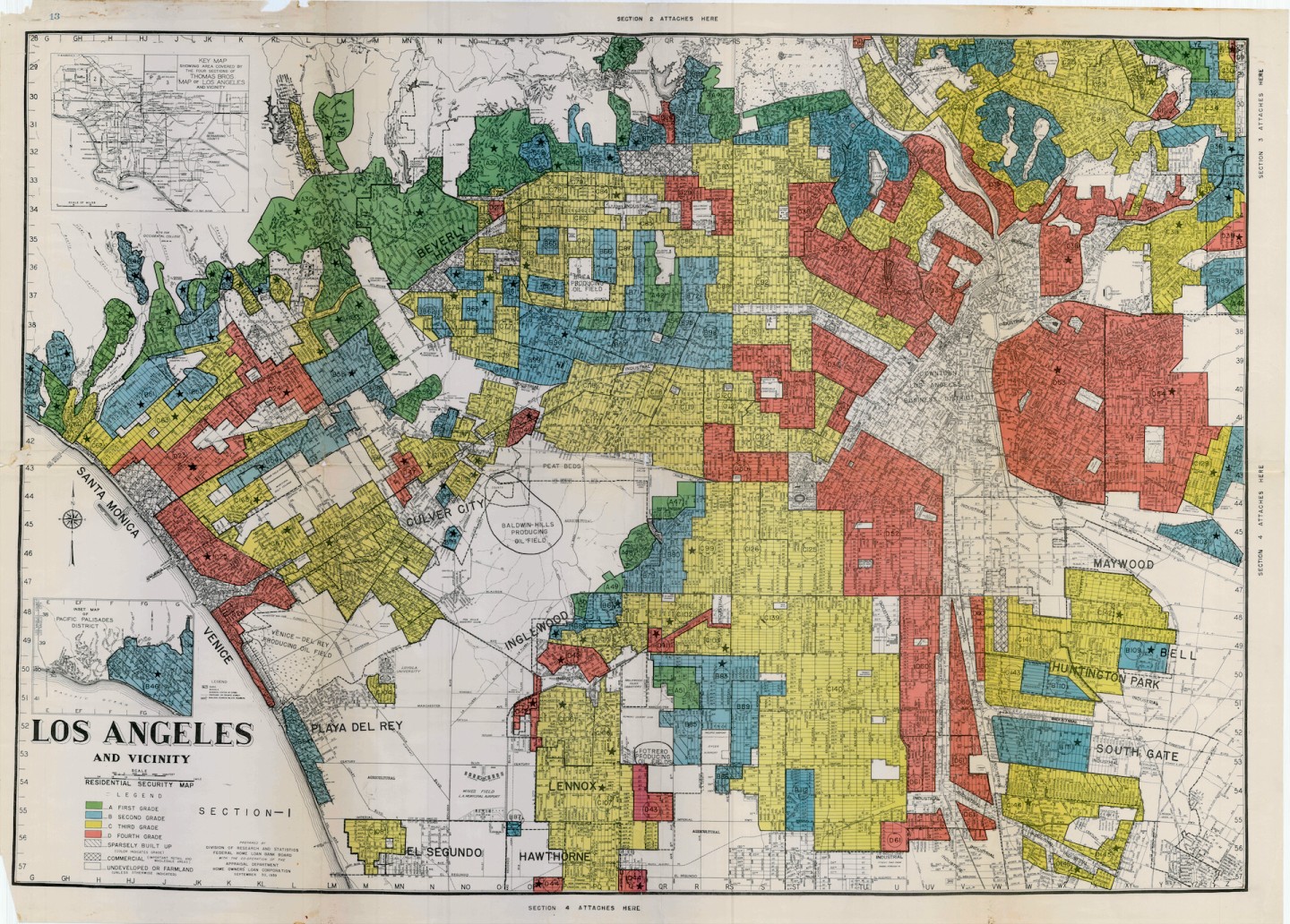

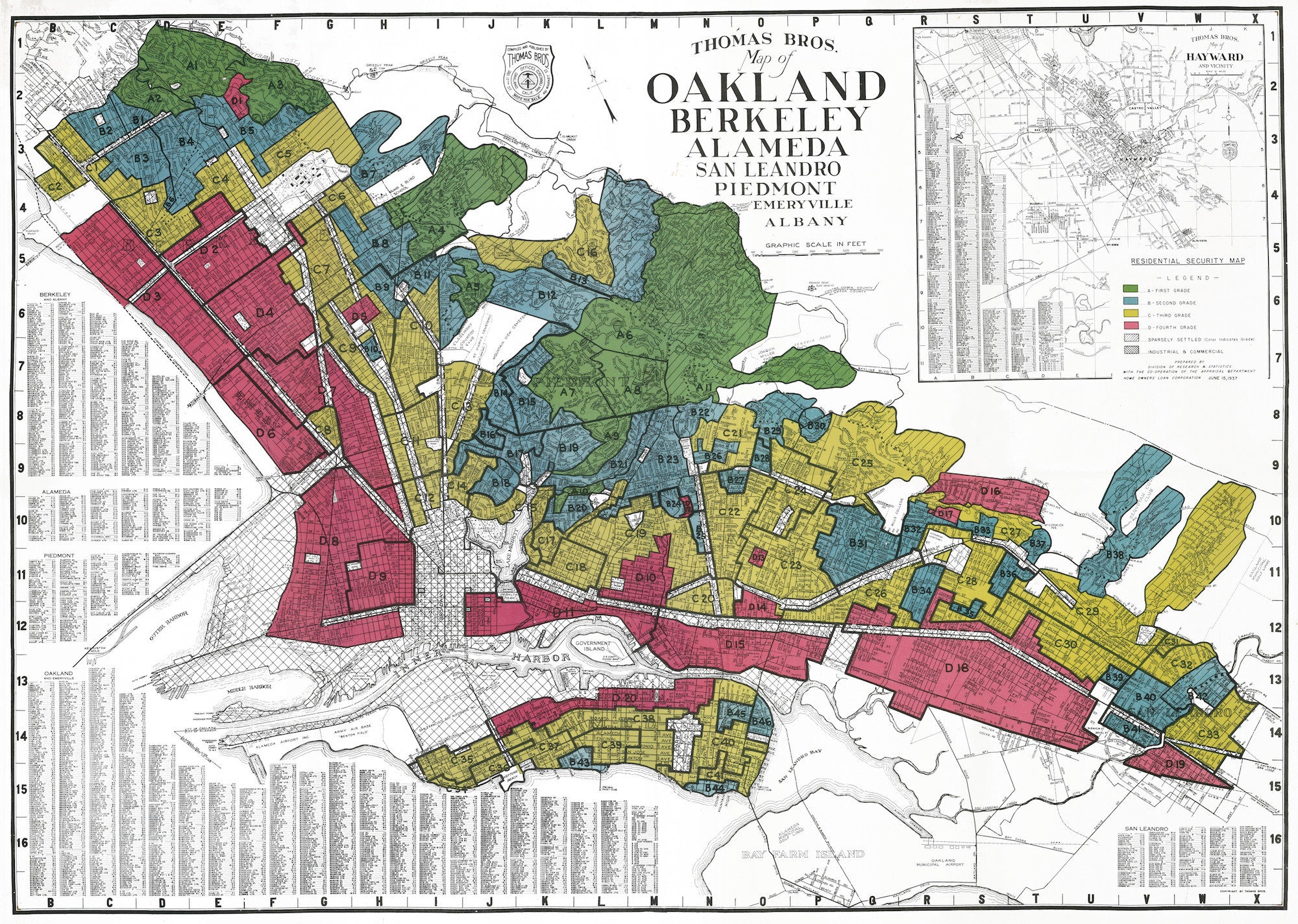

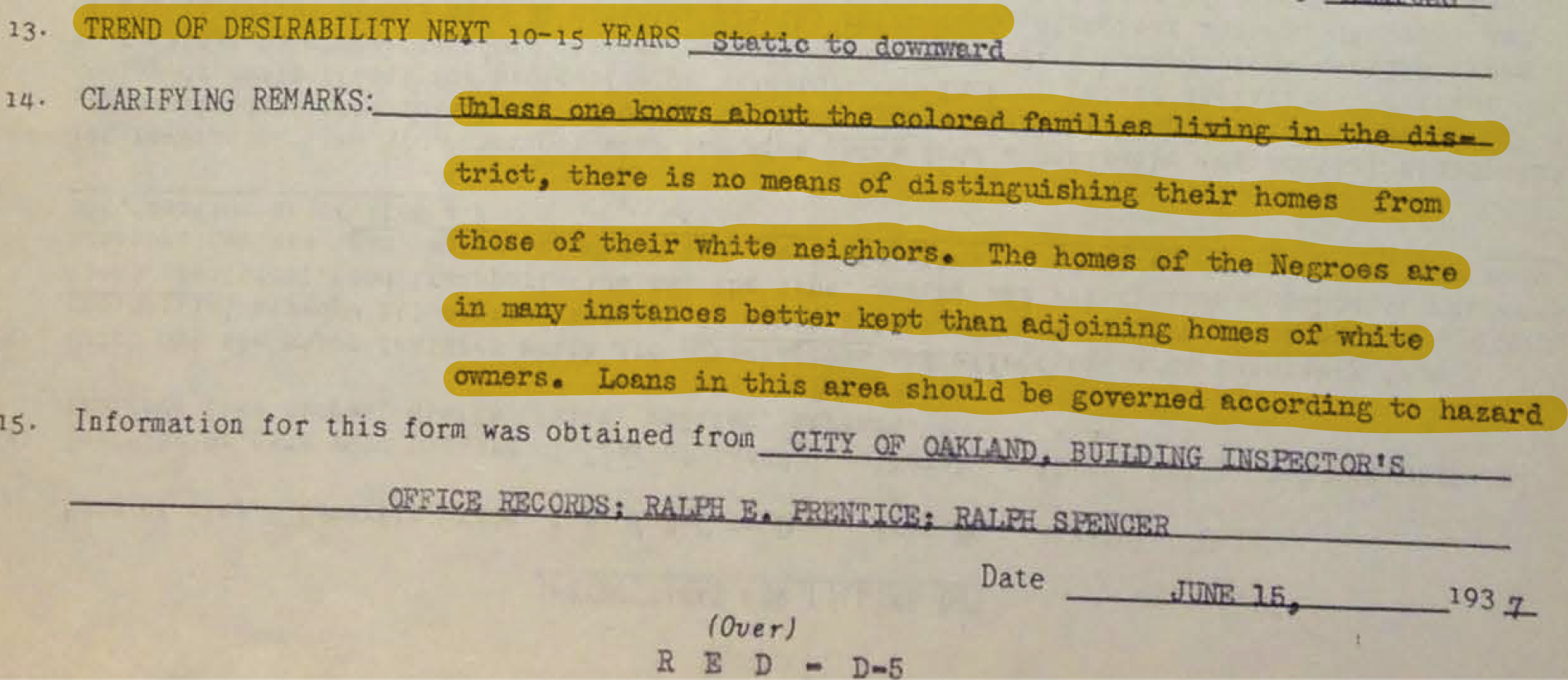

U.S. federal housing policies in the 20th century mandated segregation and undermined the ability of Black homeownership and wealth generation.

Redlining is a discriminatory practice that puts services out of reach for residents of certain areas based on race or ethnicity. It can be seen in the systematic denial of mortgages, insurance, loans, and other financial services based on location (and that area’s history) rather than on an individual’s qualifications.

Redlining actively widened the Racial Wealth Gap in the United States.

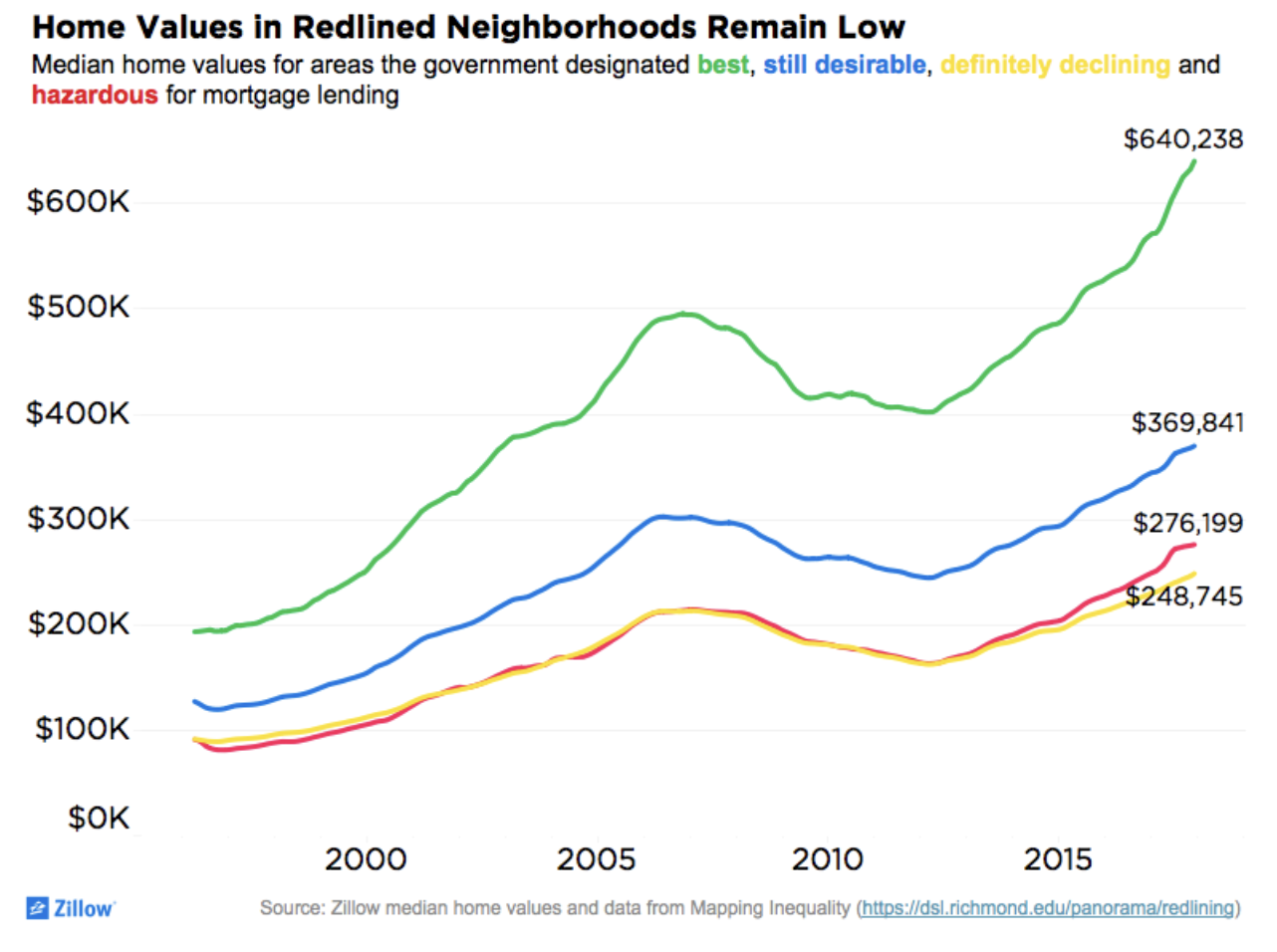

Homes in the majority of neighborhoods “redlined” as hazardous by the federal government 80 years ago are lower in value now than in areas rated more highly then.

“An analysis of property values in 1996, property in redlined neighborhoods was worth less than half that of homes in what the government had deemed as “best” for mortgage lending. That disparity has only grown greater in the last two decades.” (Read Zillow’s “Home Values Remain Low in Vast Majority of Formerly Redlined Neighborhoods”)

Federal discrimination – financial and racial – codified less than a century ago continues to affect homeowners, whole communities affected by poverty, and stifle Black wealth.

Homes in the majority of neighborhoods “redlined” as hazardous by the federal government 80 years ago are lower in value now than in areas rated more highly then.

“An analysis of property values in 1996, property in redlined neighborhoods was worth less than half that of homes in what the government had deemed as “best” for mortgage lending. That disparity has only grown greater in the last two decades.” (Read Zillow’s “Home Values Remain Low in Vast Majority of Formerly Redlined Neighborhoods”)

Federal discrimination – financial and racial – codified less than a century ago continues to affect homeowners, whole communities affected by poverty, and stifle Black wealth.

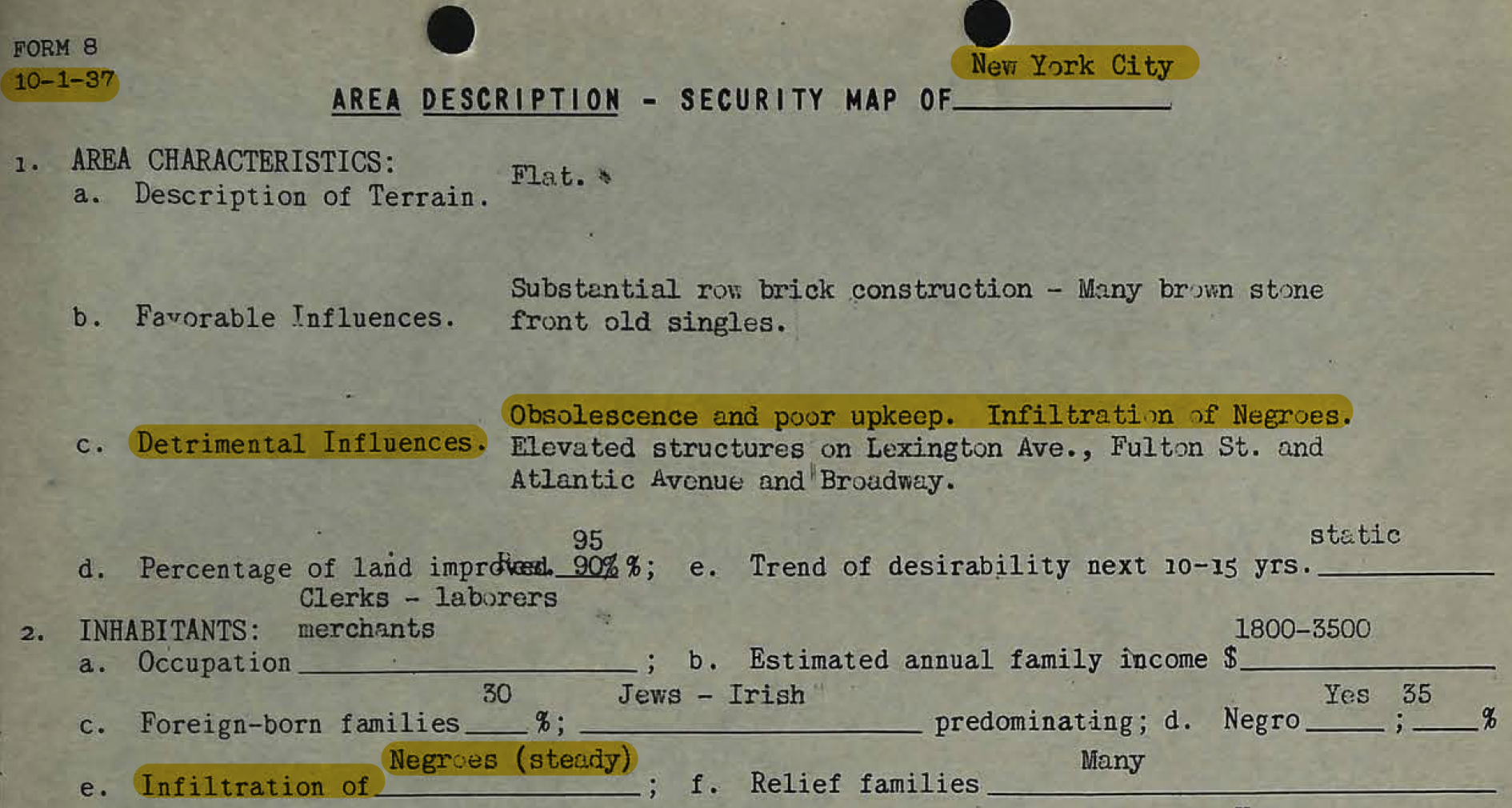

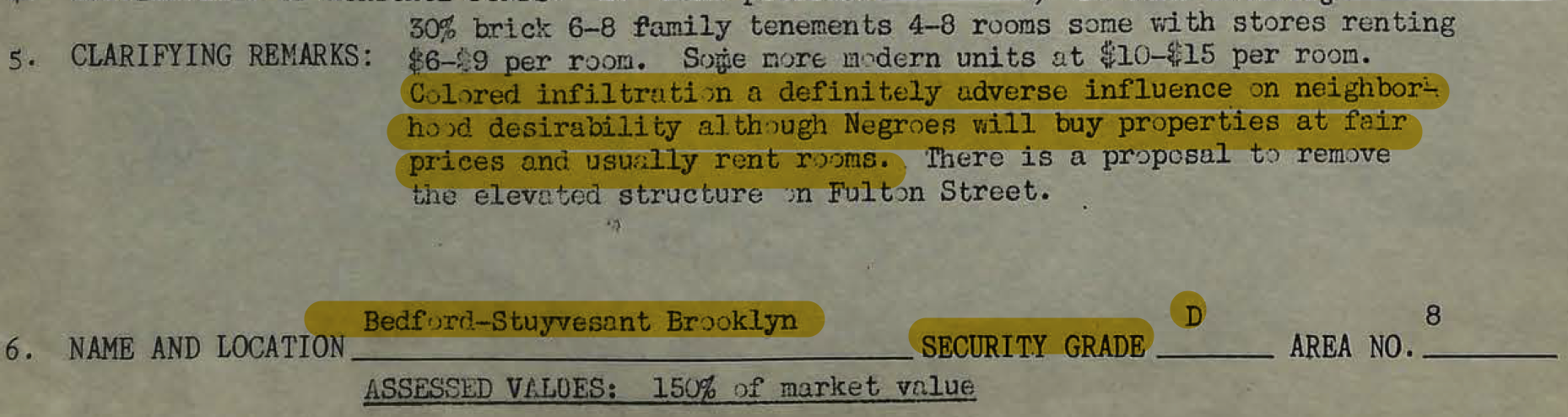

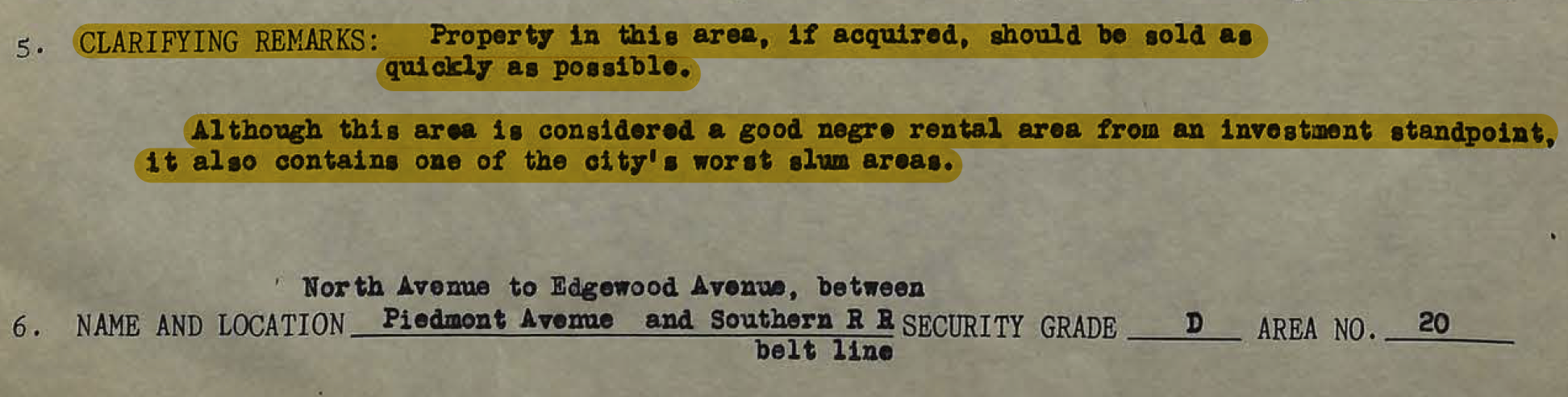

See below for official discriminatory comments and redlined maps (1937)made by the Home Owners’ Loan Corporation, the government-sponsored corporation created as part of the New Deal.

“Colored infiltration a definitely adverse influence on neighborhood...”

“Property in this area, if acquired, should be sold as quickly as possible.”

“Occupied by Negroes and other subversive racial elements.”

“Infiltration of colored residents.”

The State of Property Ownership:

Of the $30.8 trillion in total real estate assets reported in 2020 Q2,

Black households held 5% ($1.6 trillion),

White households held 78% ($23.9 trillion).

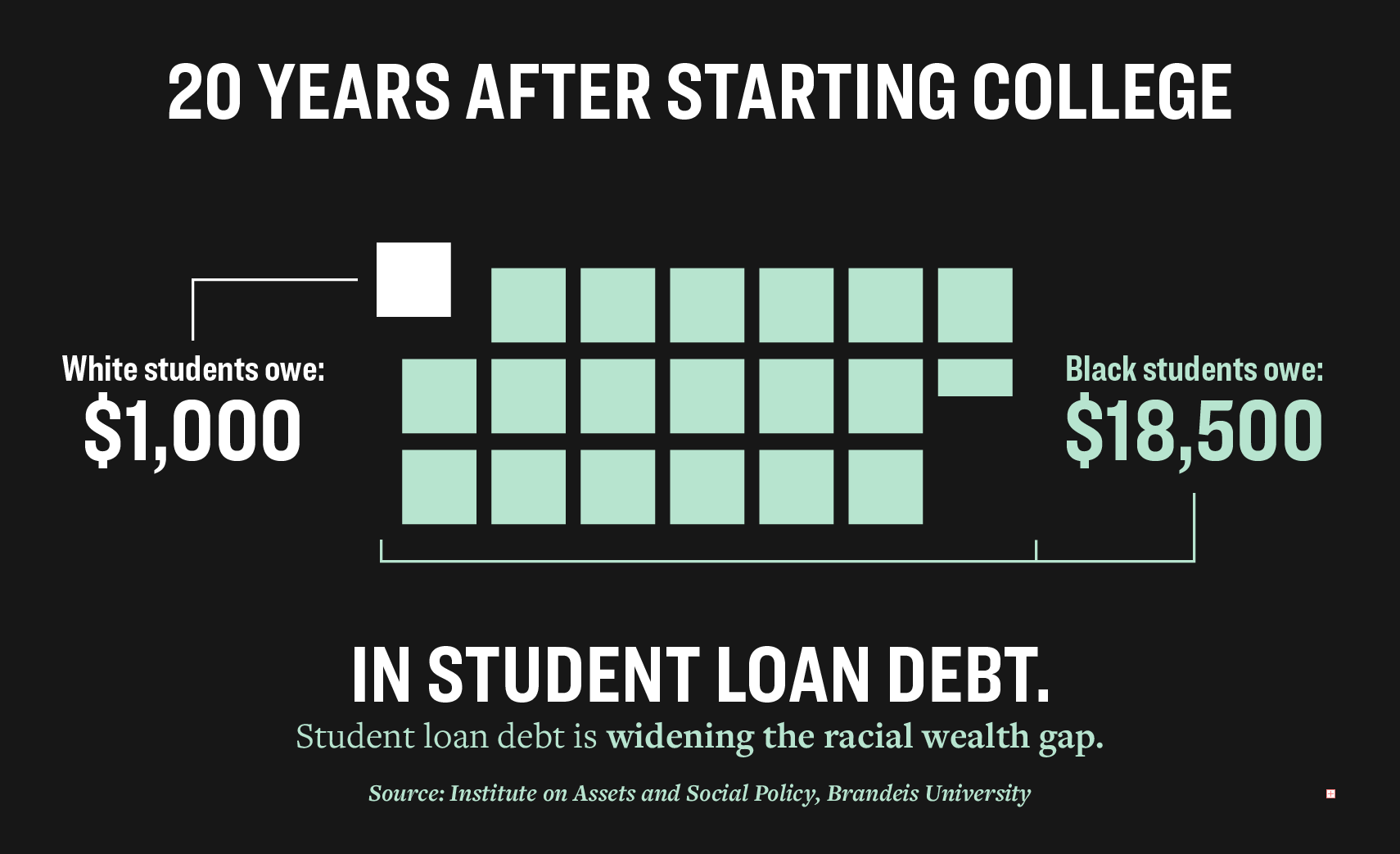

The result of converging debt and income realities are long-term entrapments with student debt that exacerbate the racial wealth gap.

The historic gap in Black land, or property, ownership directly correlates to the inability of Black student debt holders to own a home.

See Ch.2, the Data, for facts on the false choice descendants of enslaved people must make between higher education and homeownership.

Higher Education:

20 years after starting college, the median student debt of White borrowers has been reduced by 94% whereas the median Black borrower still owes 95% of their student debt.

50% of Black graduates defaulted on their loans within the same period.